Lesson

Dashboard

Lesson 1

Family Selection

Lesson 2

Family Data File

Lesson 3

Attendance

Lesson 4

Provider Participation

Lesson 5

Provider Reimbursement

Lesson 6

Parent Involvement & Education

Lesson 7

Health & Social Services

Lesson 8

Site Licensure

Lesson 9

Adult-Child Ratios

Lesson 10

Environment Rating Scale

Lesson 11

Nutritional Needs

Lesson 12

Desired Results Profile & Data

Lesson 13

Qualified Director

Lesson 14

Staff Development/Provider Support

Lesson 15

Refrain from Religious Instruction

Lesson 16

Inventory Records

Lesson 17

Annual Evaluation Plan

Lesson 18

Fiscal Essentials: CFCC Contract Type

Requirement

The Child Development Fiscal Services (CDFS) fiscal report forms include sections for Revenue & Expenses. Revenue should only be reported when its corresponding expenses are also reported. Expenses should be reported only if there is corresponding income that is also being reported.

Reference

Fiscal Handbook: Child Care Fiscal Handbook

California School Accounting Manual

Watch Video Lesson ❯

Sample Forms/Tools ❯

Review Sketch Pad Notes ❯

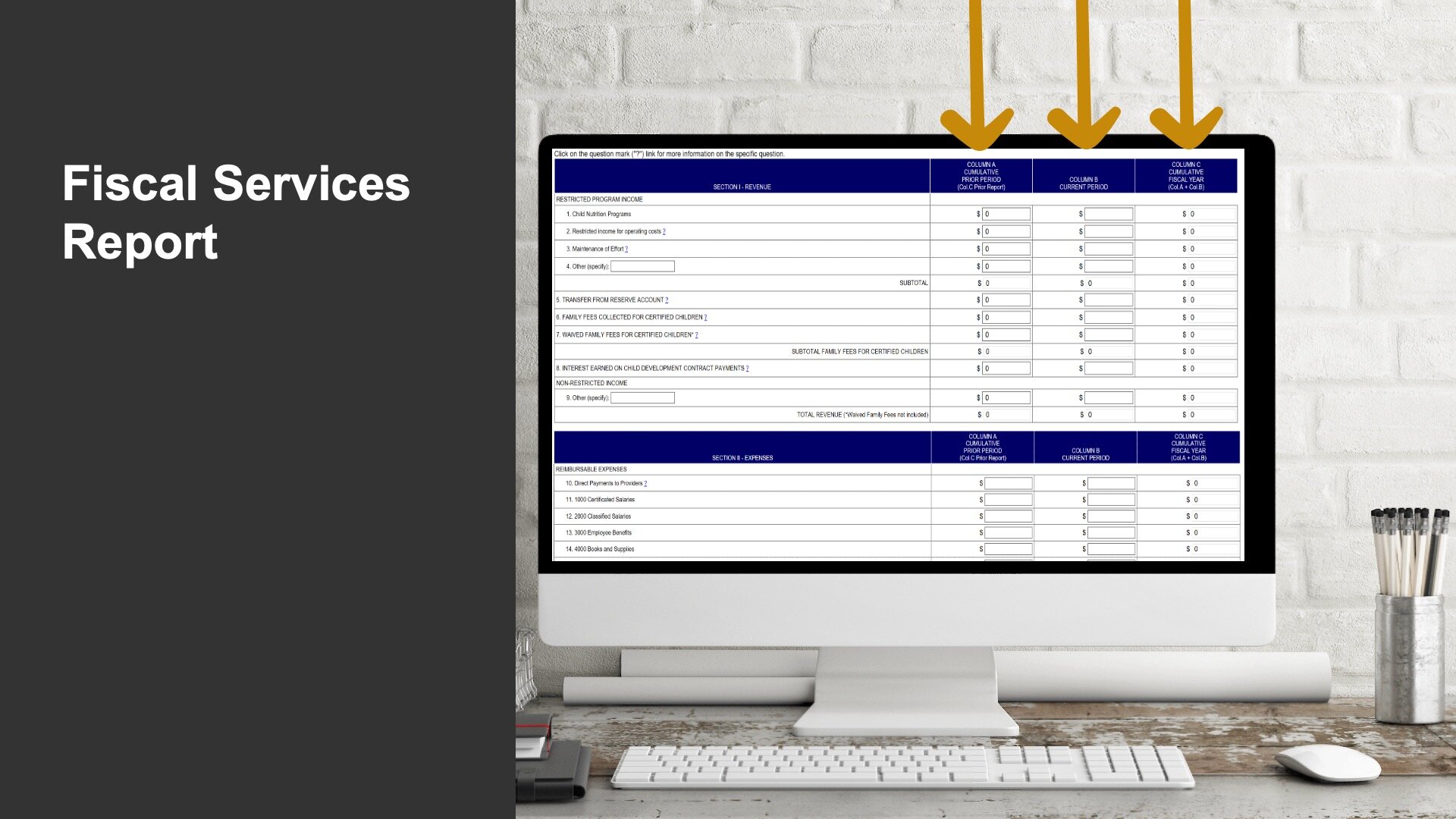

Fiscal Services Report

Contractors are required to submit the Child Development Fiscal Services Report which calculates projected earnings & directly impacts apportionments. It is crucial that the report accurately reflects both revenue & expenses.

The accrual accounting method must be used when reporting revenue & expenses. Contractors must report costs as they are incurred or when goods are received, not as they are paid.

Fixed costs must be prorated & spread out for the entire period. This includes:

Insurance

Utilities

Rent

When reporting, round all revenue & expenses to the nearest dollar. Negative numbers are not accepted on the online report forms.

For contractors serving in multiple counties, report data for all counties served on one report.

Report Detail

The Fiscal Services Report is divided up into 3 columns:

Column A Cumulative Prior Period: Represents cumulative total of prior reporting periods revenue and expenses.

Column B Current Period: Represents revenue & expenses for the current reporting period only.

Column C Cumulative Fiscal Year: Represents the fiscal year total to date. The prior & current period are automatically added together.

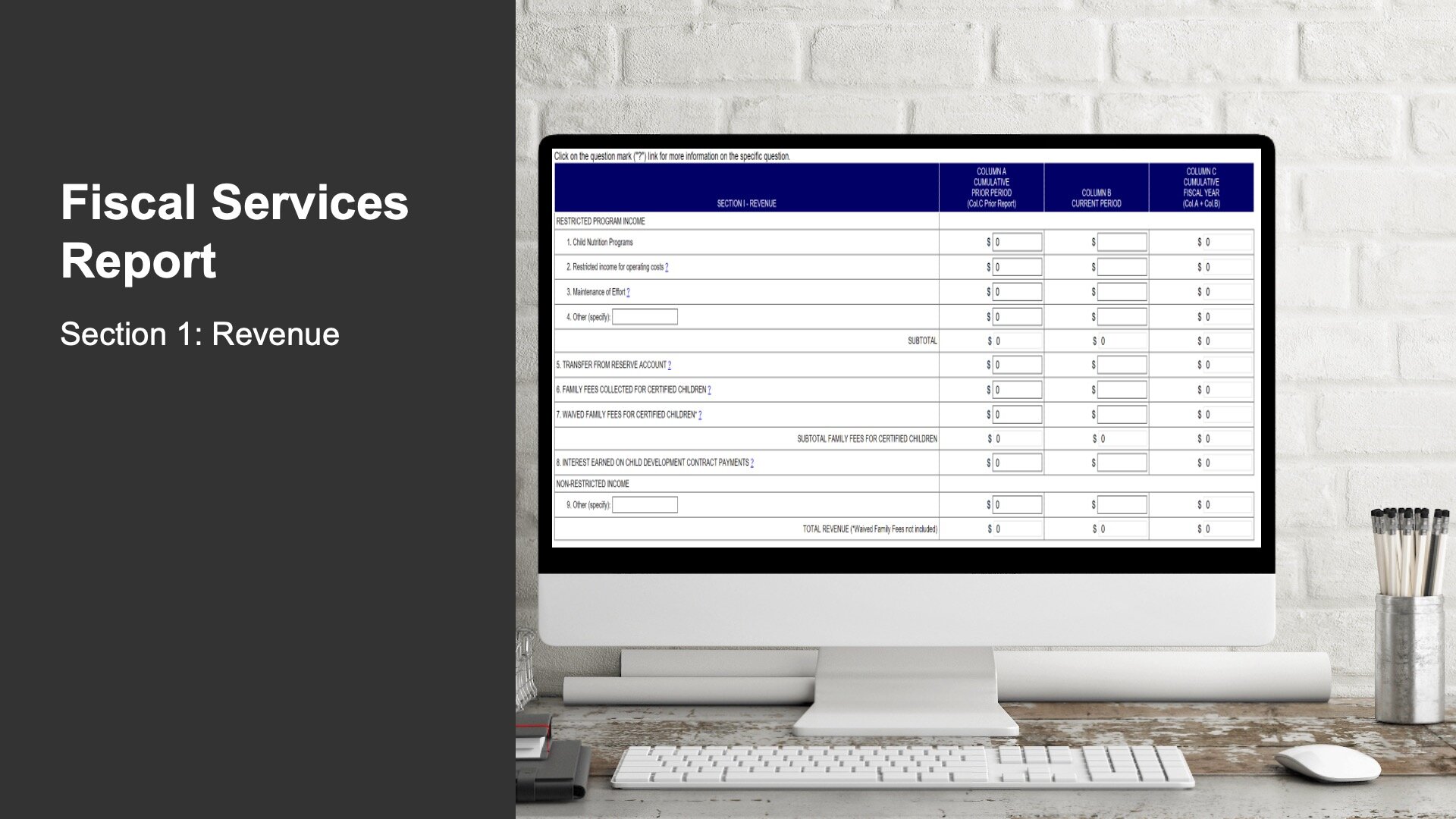

Section 1: Revenue

Revenue is reported under Section 1 of the Fiscal Services Report & includes:

Restricted income

Funds transferred from your reserve account

Family fees for certified children

Interest earned on apportionment payments

Non-restricted income

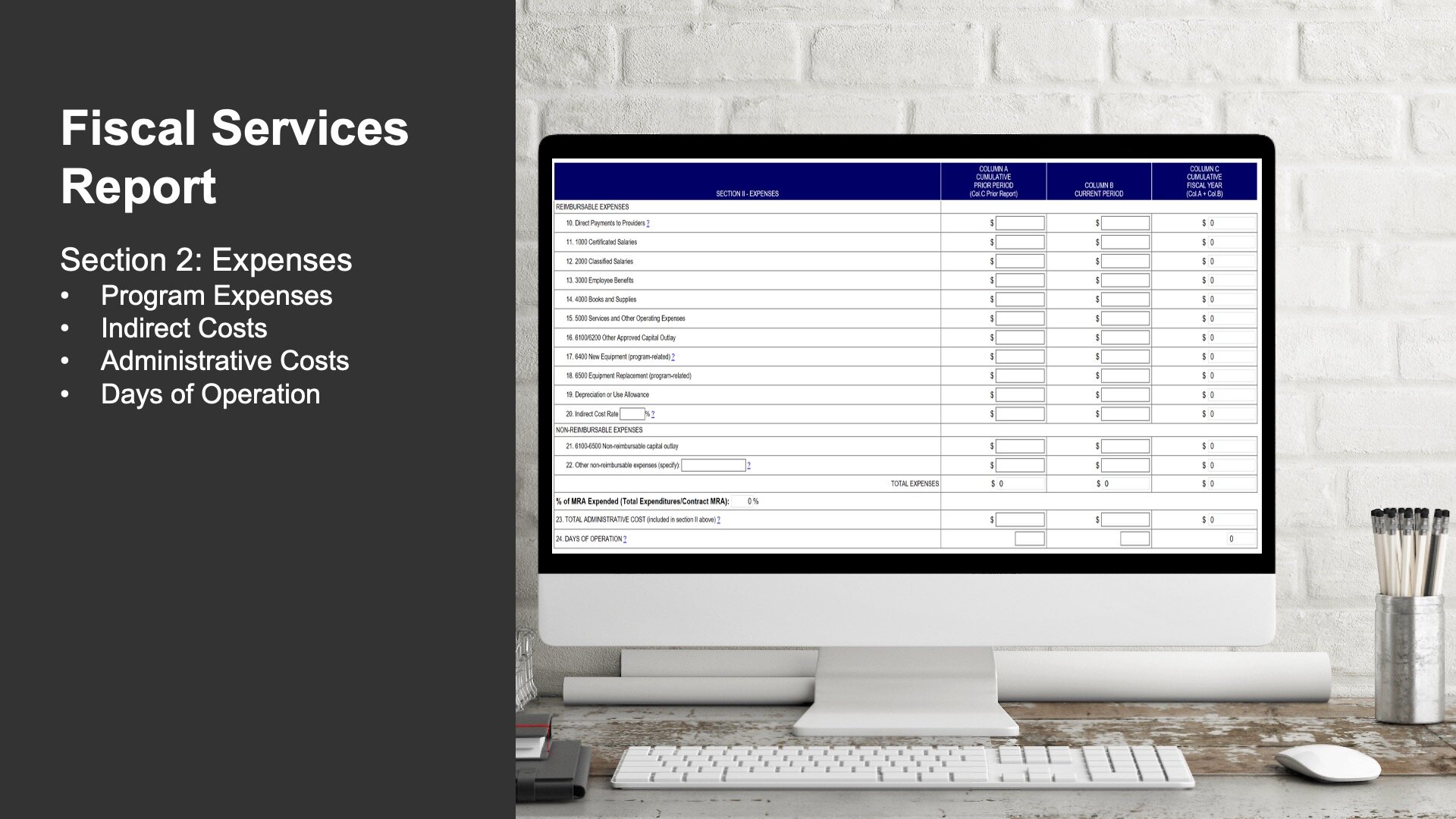

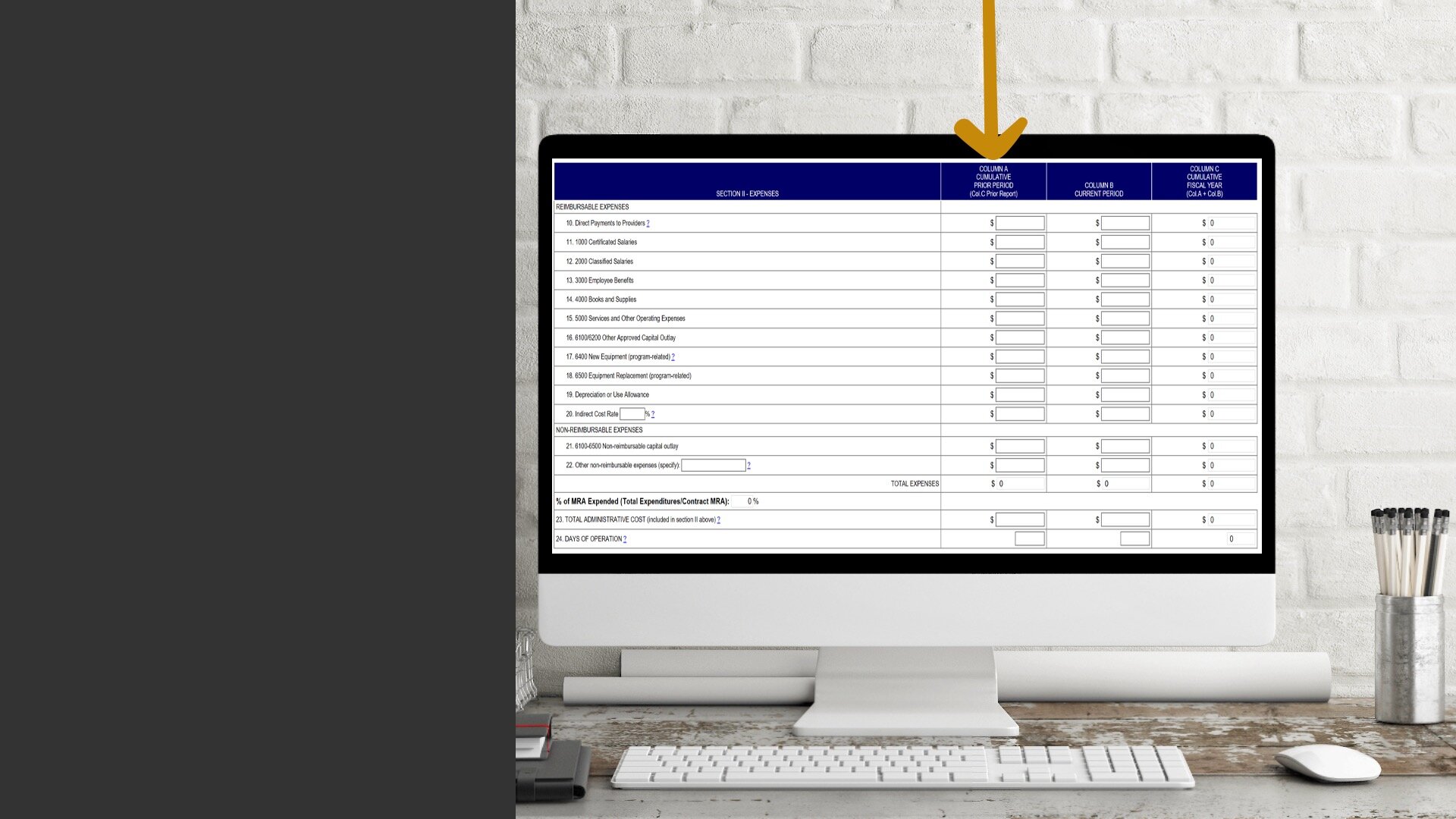

Section 2: Expenses

Expenses are reported under Section 2 & includes:

Program expenses such as:

Provider payments

Salaries

Benefits

Equipment costs

Note: The fiscal report includes accrued provider payments. This is the amount of provider payments you expect or project to pay.

Indirect costs which include your administrative costs. Indirect costs cannot exceed 10% or the LEA pre-approved indirect cost rate & agencies must have a cost allocation plan in place.

Total administrative costs that were included in the reimbursable expense section. Administrative costs are costs for activities that do not provide a direct benefit to children, including any allowance for indirect costs & audits. Administrative costs may not exceed 15 % of net costs.

Days of Operation

Fiscal Report Revision

When a correction needs to be made to a Fiscal Services Report, an amended report is not required (except for the June year-end).

Adjustments must be made by reporting the corrected figures in the Cumulative Prior Period column on the next report to be filed & reasons stated for the adjustments or corrections made in the Comments section of the current report.

Note: Reports not received or that are incomplete are delinquent, & apportionments will be withheld until report requirements have been met. Ensure reports are accurate & submitted on time.

General Recordkeeping Requirements

Contractors are required to retain all records for a minimum of 5 years.

Additionally, Claims for Reimbursement shall not be paid, unless there are documents to support the claims.

Finally, during a monitoring review, the agency will need to provide their original supporting sign in/out sheets that support their claims for reimbursement

Complete Knowledge Check ❯

After reviewing the video lesson & sketch pad notes, it’s time to check for understanding by completing a Knowledge Check. Note that Individual Knowledge Checks will conclude with a Certificate.