Lesson 5

Provider Reimbursement

Lesson 6

Parent Involvement & Education

Lesson 7

Health & Social Services

Lesson 8

Site Licensure

Lesson 9

Adult-Child Ratios

Lesson 10

Environment Rating Scale

Lesson 11

Nutritional Needs

Lesson 12

Desired Results Profile & Data

Lesson 13

Qualified Director

Lesson 14

Staff Development/Provider Support

Lesson 15

Refrain from Religious Instruction

Lesson 16

Inventory Records

Lesson 17

Annual Evaluation Plan

Lesson 18

Fiscal Essentials: CFCC Contract Type

Lesson 19

Fiscal Essentials: CCTR Contract Type

Lesson 20

Audits

Lesson 21

CDMIS 801A & 801B Reporting

Lesson 22

Contractor Policies

Compliance Indicator

Reimburse each provider no more than that provider charges families, not to exceed the maximum subsidy amount which is the applicable regional market rate based on the age of the child, certified need for childcare and the facility type. Providers are reimbursed based on current regulations.

Regulations/Reference

CCD Program Instrument: I. Family Files CCD 06

Welfare & Institutions Code: 10280

Title 5: 18074.2, 18075, 18075.1, 18076.1, 18076.2, 18084.2, 18226, 18228

Monitoring Review Evidence

Provider Documentation of Childcare Certificate

Provider Rates

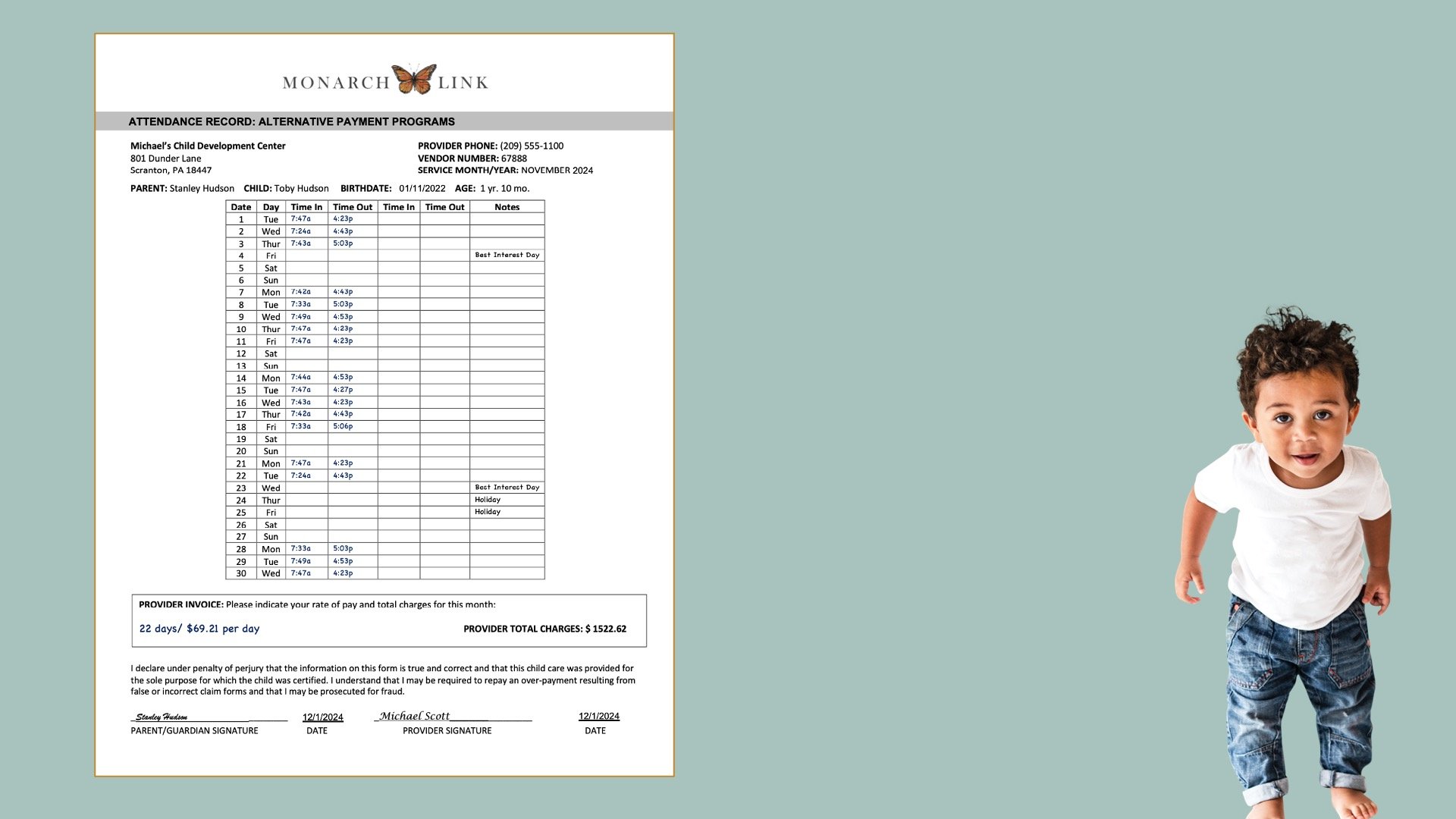

Sign-in/Sign-out Records/Invoice

Provider Payment

Written Materials to Parents

Watch Video Lesson ❯

Sample Forms/Tools ❯

Review Sketch Pad Notes ❯

Rate Determination

Under the General Child Care contract, a state contractor is reimbursed based on their contracted rate for each child day of enrollment. In turn providers are reimbursed based on either their non-subsidized rate or the agency determined rate.

The provider reimbursement rate required specific considerations such as:

Considering the program’s operational costs

Reimbursing providers based on the 70/30 Rule

70% of contract funds are earmarked for provider reimbursement while the remaining 30% is set aside for Administrative & Support Costs.

Considering their counties RMR Ceilings

What this might look like in a program:

Establish rate categories such as:

Infants

Toddlers

Three & Older

Exceptional Needs

Within each of these categories, providers would be reimbursed 70% of the contractor’s adjusted rate for each of those categories at either a PT or FT rate.

Reimbursable Care

Through June 30, 2025, CCTR FCCHEN providers will be reimbursed based on the family’s maximum certified need rather than attendance.

When a parent has consistent certified days and hours of care, reimbursement to both a licensed and license-exempt provider is based on the family’s maximum authorized hours of care.

When a parent has a variable schedule, reimbursement is based on the family’s maximum authorized hours of care.

It is common to follow the same CCTR guidelines for reimbursable absences such as:

Excused absences

Alternate provider days (must be with a FCCHEN provider)

What this might look like in a program:

Contractors develop a system to track & monitor reimbursable care that is limited to ensure overpayment does not occur.

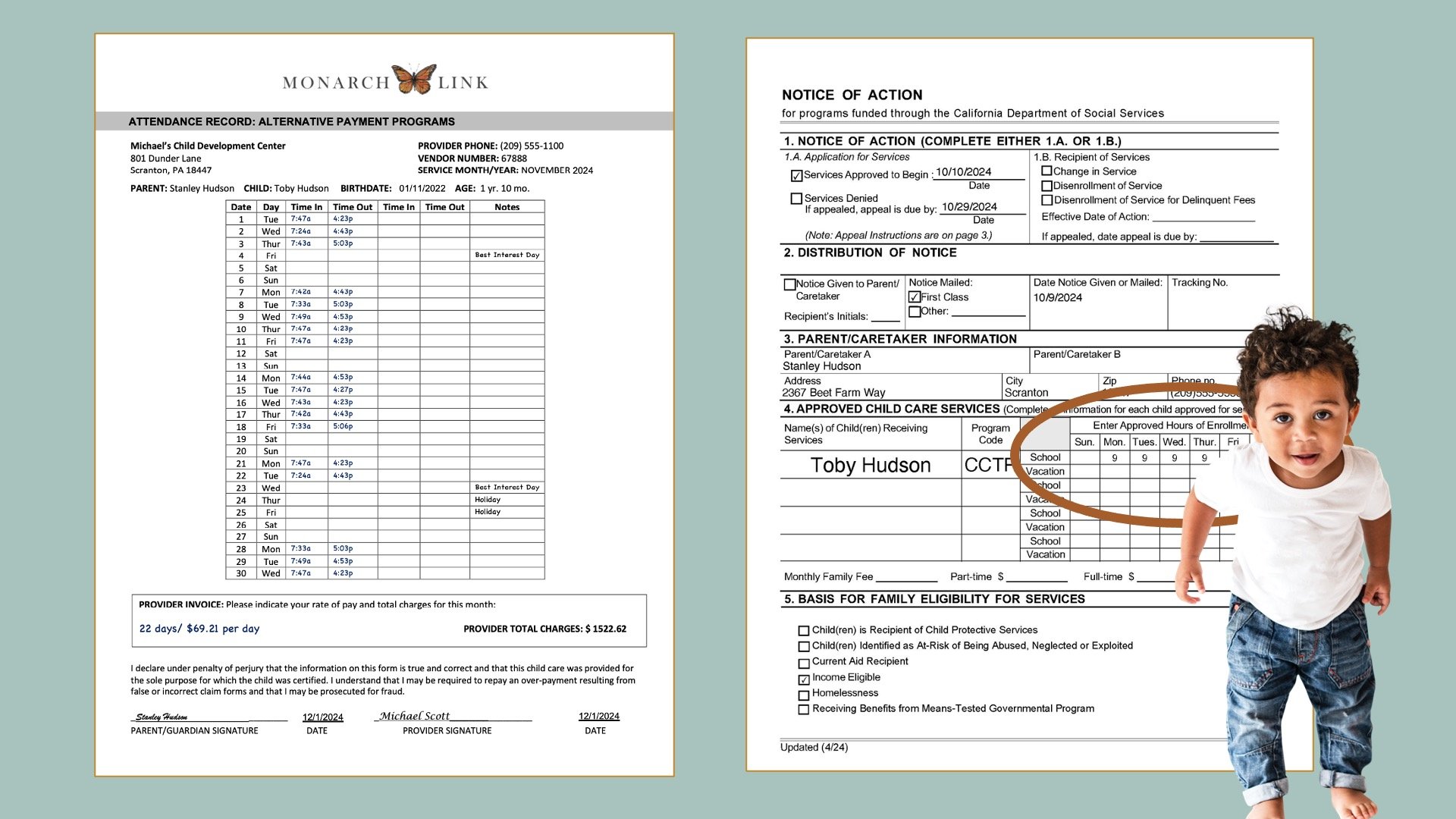

Any change to the certified need must be based upon a request by the parent & communicated in writing to the provider on the same day as family Notice of Action.

Non-Reimbursable Care

Reimbursable care does not include:

Scheduled instructional minutes for a school aged child

Time when the child is receiving any other child care & development services

When a provider is not open

Effective November 15, 2021, for school-age children, contractors must only reimburse providers during non-school hours when a school-age child is enrolled and participating in in-person instruction or for days/hours that a school-age child is participating in distance learning while in a child care setting only when the child’s school is closed and in-person instruction is not available.

NOTE: Reimbursement may not be issued to providers for any days/hours of care that take place when in-person instruction is available, but the parent opts to enroll their school-age child in remote learning.

Provider Reimbursement

When applying the FCCHEN Provider Rate, use the age of the child, adjustment factor criteria, & certified need for child care to identify the applicable rate category.

Based on the certified days & hours of services determined at the time of certification or recertification as documented on the Notice of Action, all providers are reimbursed at the daily rate.

Full-time Daily: Child’s certified schedule is 25 hours or more per week

Part-time Daily: Child’s certified schedule is less than 25 hours total per week

Issuing Reimbursement

Contractors may set up an electronic reimbursement program for providers so that the reimbursement to providers may be electronically transmitted to the financial institution of their choice.

NOTE: Contractors may not require the providers to use direct deposit or any other form of electronic reimbursement to receive their reimbursements.

Provide a description of the reimbursement to the provider, including:

Child(ren) served

Month of service covered by the reimbursement

Misleading Records

Contractors should not make payment to a provider if they have information that might include, but is not limited to, the following:

The provider was incarcerated during the time s/he claimed to have provided care.

The provider was out-of-state during the time she or he claimed to have provided care.

A licensed provider lost their license & was directed to cease providing care but did not

If a contractor receives an attendance record that clearly reflects misleading or deceitful information, the contractor must follow their written polices & take appropriate action.

Complete Knowledge Check ❯

After reviewing the video lesson & sketch pad notes, it’s time to check for understanding by completing a Knowledge Check. Note that Individual Knowledge Checks will conclude with a Certificate.