Lesson

Dashboard

Lesson 1

Family Selection

Lesson 2

Family Data File

Lesson 3

Attendance

Lesson 4

Provider Participation

Lesson 5

Provider Reimbursement

Lesson 6

Parent Involvement & Education

Lesson 7

Health & Social Services

Lesson 8

Site Licensure

Lesson 9

Adult-Child Ratios

Lesson 10

Environment Rating Scale

Lesson 11

Nutritional Needs

Lesson 12

Desired Results Profile & Data

Lesson 13

Qualified Director

Lesson 14

Staff Development/Provider Support

Lesson 15

Refrain from Religious Instruction

Lesson 16

Inventory Records

Lesson 17

Annual Evaluation Plan

Lesson 18

Fiscal Essentials: CFCC Contract Type

Lesson 19

Fiscal Essentials: CCTR Contract Type

Compliance Indicator

The program has submitted a report for each contract that is consistent with the laws for state or federal fiscal reporting and accounting.

Regulations/Reference

CCD Program Instrument: V. Fiscal/Audit CCD 21

Title 5: 18068

Fiscal Handbook: Child Care Fiscal Handbook

California School Accounting Manual

Monitoring Review Evidence

Child Development Fund

Fiscal Attendance & Accounting Reports

Watch Video Lesson ❯

Sample Forms/Tools ❯

Review Sketch Pad Notes ❯

Fiscal Reporting

Contractors are required to submit monthly or quarterly fiscal reports depending upon their contract. Monthly reporting is required for “Contractors on conditional or provisional status” For all other contractors, fiscal reports are submitted quarterly. Reports are due by the 20th of the month following the end of the reporting period.

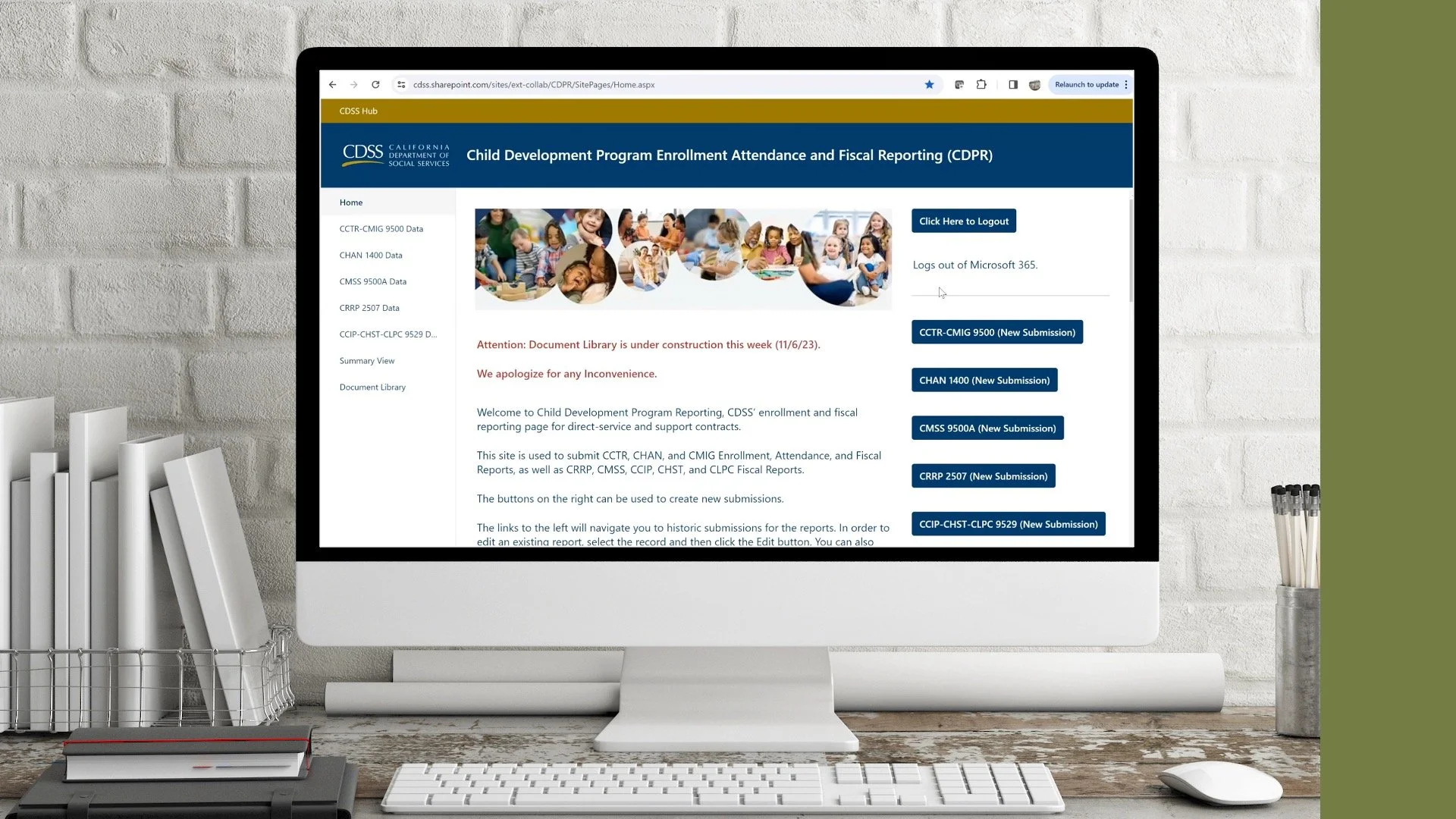

Fiscal data is submitted online within the within the Child Development Program Enrollment Attendance and Fiscal Reporting platform, known as CDPR. CDPR is an enrollment and fiscal reporting platform hosted through Sharepoint through which center-based child development programs, as well as support contracts, submit required attendance and fiscal reports.

Days of Operation

Minimum Days of Operation (MDO) impact a contractors Maximum Reimbursable Amount (MRA). MDO is reported in CDPR at the contract level, inclusive of all service counties.

A “Day of Operation” is a day at least 1 FCCHEN provider, provides child care & development services for one or more certified children enrolled.

Since MDO impacts funding, contractors must ensure they are on target to meet their MDO. On year-end calculations if the actual days of operation are:

Greater than or equal to 98% of the MDO, the MRA will not be affected

Less than 98% of the MDO, the MRA will be reduced in proportion to the percentage of the MDO that the contractor was not in operation. This could result in a billing if the contractor has been paid more than the reduced MRA.

NOTE: If your MDO needs changed from what was submitted at the time of initial or continued funding application, submit a revised calendar, along with a Program Calendar Change form.

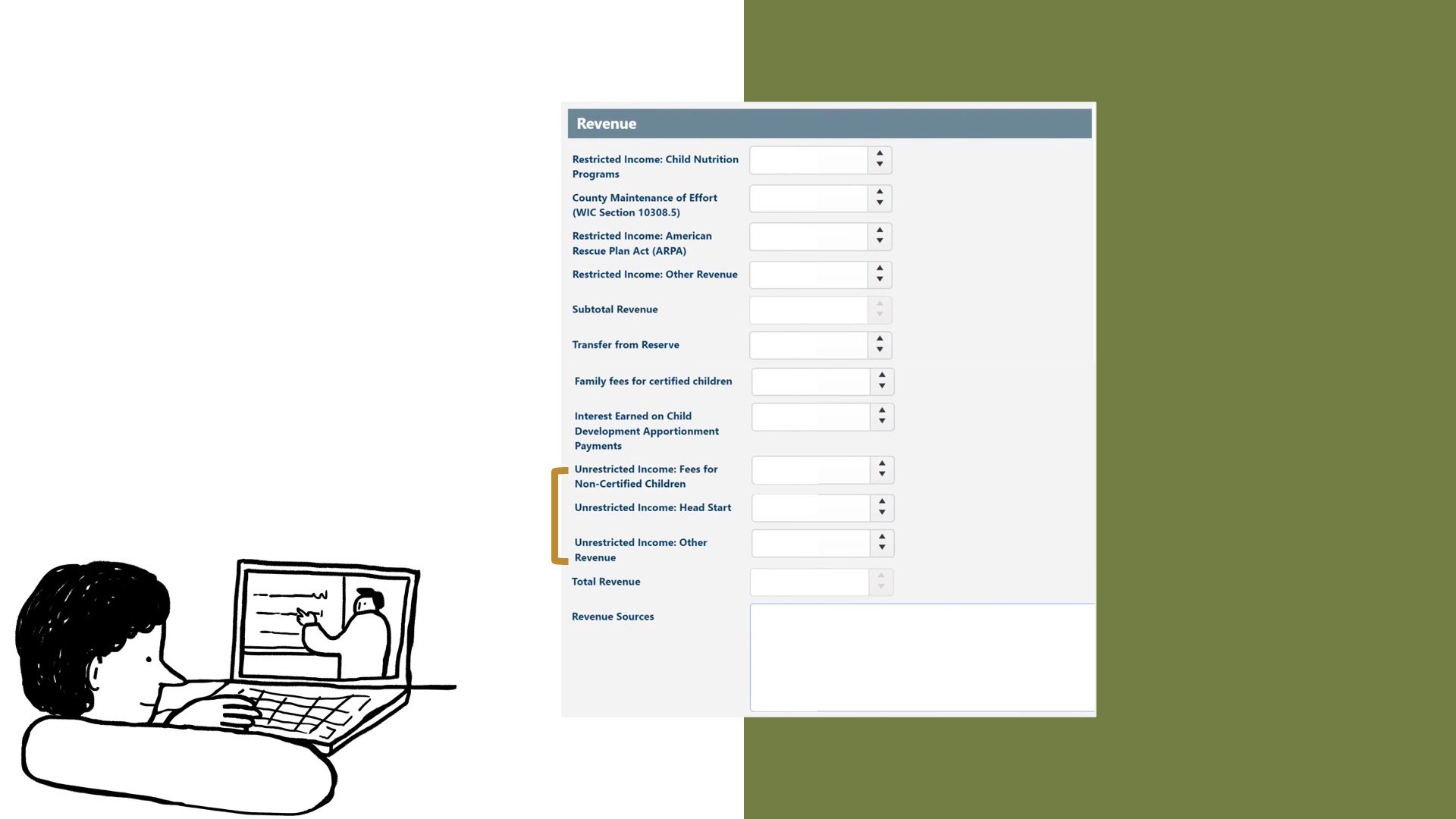

Revenue

Contractors are required to report all revenue related to the program for both certified & non-certified children in CDPR.

Do not report child development apportionment payments received from the California Department of Social Services or funds required to be reported in the Supplemental Revenue & Expense section.

Restricted Income

Restricted income is income that may only be expended for certified children or is provided for specific, limited purposes.

Within CDPR, restricted Income is entered within the top 9 rows of the Revenue Reporting page which includes:

Child Nutrition Programs

County Maintenance of Effort

American Rescue Plan Act (ARPA)

Other Revenue

Subtotal Revenue

Transfer from Reserve

Waived Family Fees of Certified Children

Family Fees for Certified Children

Interest Earned on Child Development Apportionment Payments

NOTE: The department will not reduce a contractor's reimbursement based on the amount of waived family fees reported. An additional allocation will be provided to ensure contractors do not have to absorb the cost of family fees waived.

Reserve Accounts

Contractors who earn but do not spend all of their contract funds are allowed to maintain a Reserve Account from “earned but unexpended” funds.

Contractors may retain a maximum of 15% of all center-based programs the contractor operates. The 15% General Reserve amount may be used for “reasonable & necessary costs” in excess of contract reimbursement.

To learn more about reserve accounts for all your state program contracts, please refer to the Child Care Fiscal Handbook.

Unrestricted Income

Unrestricted income is income that may be expended for certified or non-certified children, that is not provided for specific, limited purposes.

Within CDPR, unrestricted Income is entered within the final 3 rows of the Revenue Reporting page which includes:

Fees for Non-Certified Children

Head Start

Other Revenue

NOTE: For the Other Revenue boxes for Restricted Income and Unrestricted Income, if a value other than zero is entered, the user must indicate the revenue source such as grants or donations or an error message will appear.

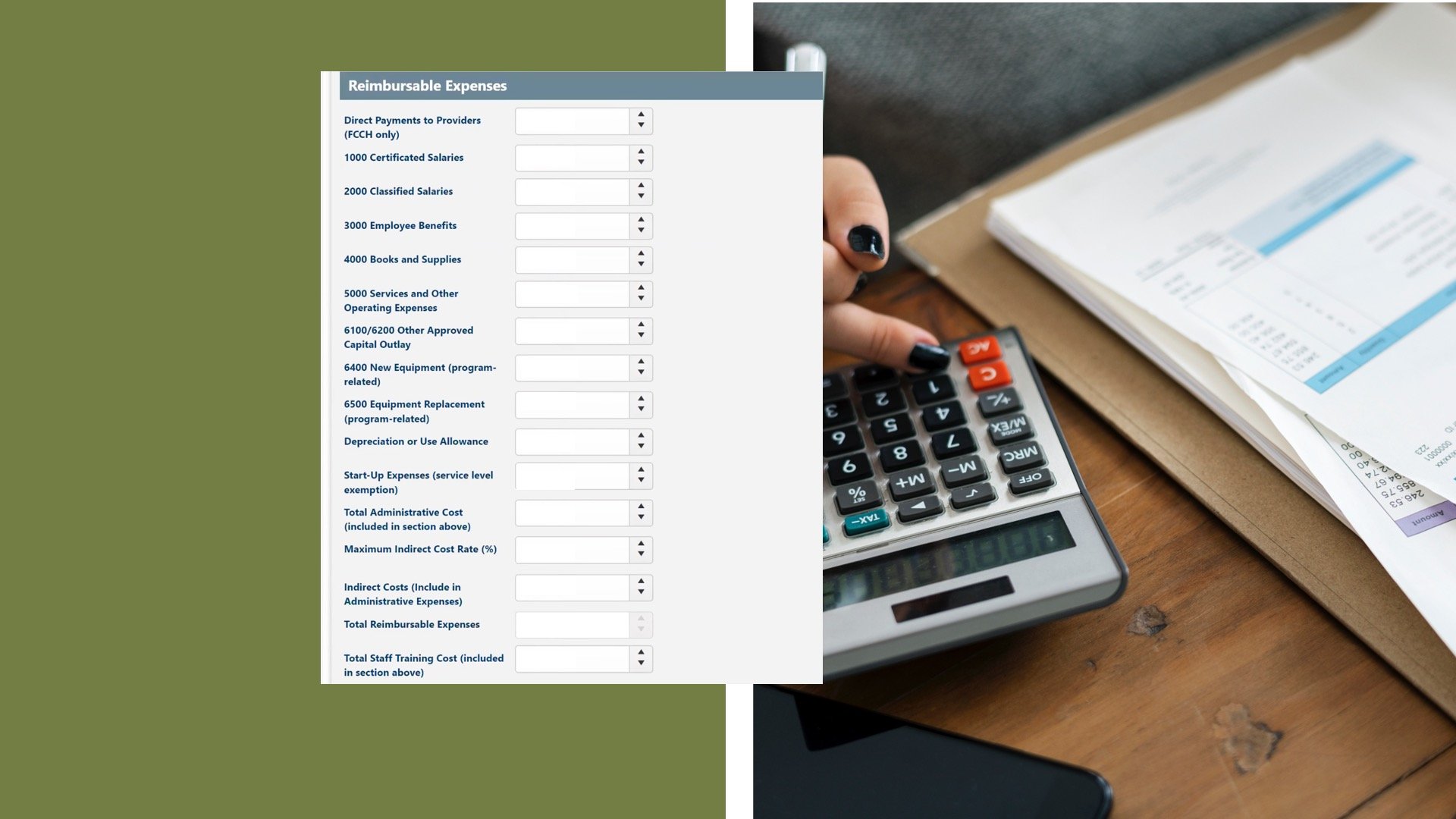

Expenses

Based on the regulations, “Contractors shall report expenditures on an accrual basis.” Within CDPR, go through each row & report costs as they incurred rather than when they are actually paid.

NOTE: Round entries to whole numbers.

Report all expenses related to the program for both certified & non-certified children including all expenses related to the income reported previously, plus contract funds.

Report the total administrative costs that were included in the reimbursable expense section not to exceed 15% of the funds. Administrative costs are costs for activities that do not provide a direct benefit to children, including any allowance for indirect costs & audits.

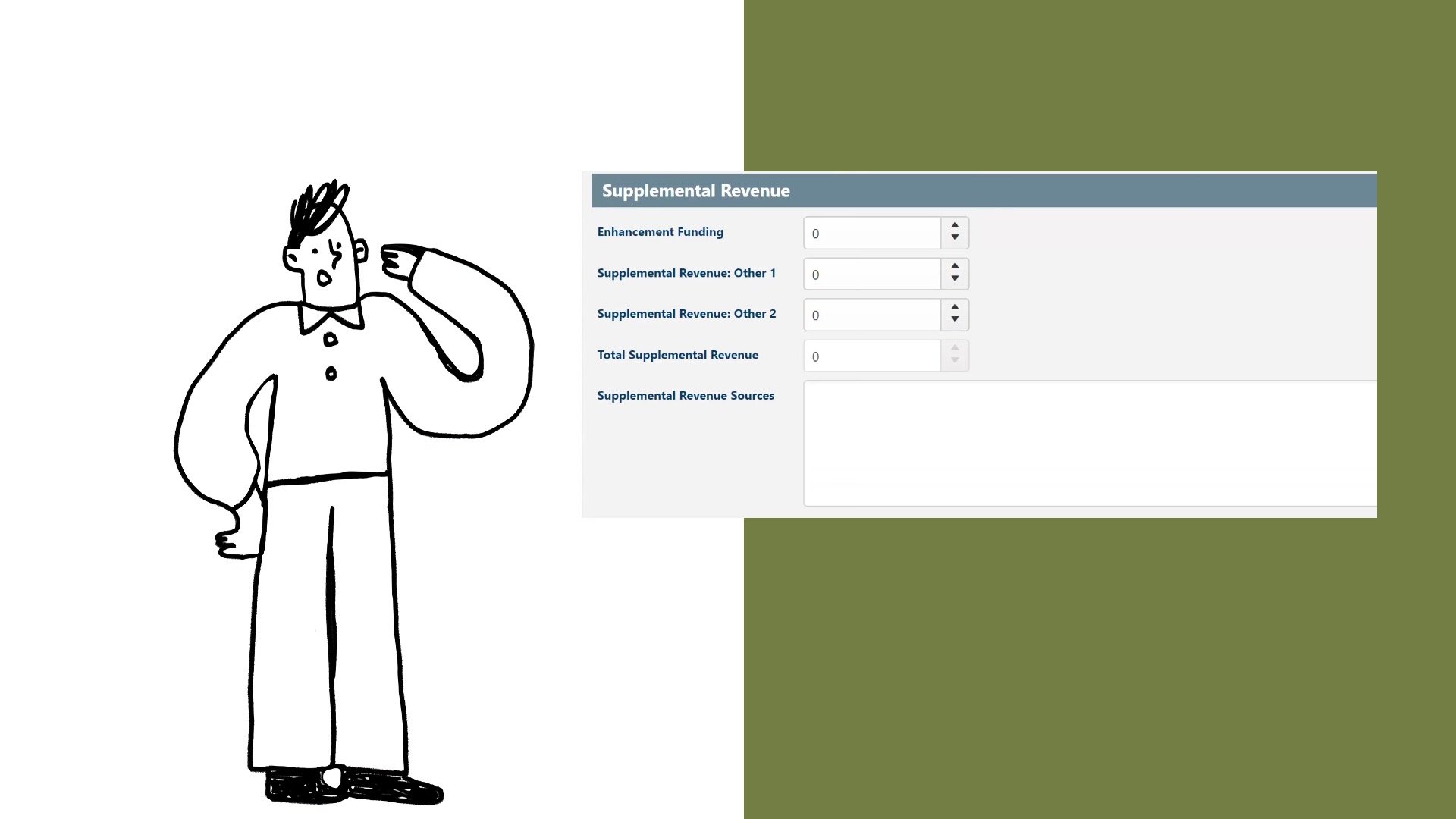

Supplemental Revenue & Expenses

If applicable, contractors must report all supplemental revenue that includes income from:

Head Start

First 5 enhancement funds

Other enhancement funds

Donations from individuals

Foundation grants

Corporate grants

Other funds intended to pay for projects or benefits beyond the basic child development services for certified or commingled children.

Within CDPR, report the supplemental expenses that includes all expenses related to the income reported in Supplemental Revenue.

NOTE: Department will not reimburse the contractor for any expenses reported on this page. If your program has no supplemental revenue and expenses just leave blank.

Finalize

CDPR will automatically summarize data entered from the previous sections.

After entering & reviewing the data, the user will select the Save button at the bottom of the page. This will save your data as a Draft or Final based the version selected within the contractor information section of the report.

When the report form is in the final version and ready to be certified, the Authorized Representative will select the reports and click on the certify function. Once certified, the box will state success.

CDPR does not allow correction of data once the report is certified and locked.

NOTE: If any adjustments are needed, contractors must contact their fiscal analyst.

General Recordkeeping Requirements

Contractors are required to retain all records for a minimum of 5 years.

Additionally, Claims for Reimbursement shall not be paid, unless there are documents to support the claims.

During a monitoring review, the agency will need to provide their original supporting sign in/out sheets that support their claims for reimbursement

Complete Knowledge Check ❯

After reviewing the video lesson & sketch pad notes, it’s time to check for understanding by completing a Knowledge Check. Note that Individual Knowledge Checks will conclude with a Certificate.