Lesson

Dashboard

Lesson 1

Family Selection

Lesson 2

Family Data File

Lesson 3

Attendance

Lesson 4

Provider Participation

Lesson 5

Provider Reimbursement

Lesson 6

Parent Involvement & Education

Lesson 7

Health & Social Services

Lesson 8

Site Licensure

Lesson 9

Adult-Child Ratios

Lesson 10

Environment Rating Scale

Lesson 11

Nutritional Needs

Lesson 12

Desired Results Profile & Data

Lesson 13

Qualified Director

Lesson 14

Staff Development/Provider Support

Lesson 15

Refrain from Religious Instruction

Lesson 16

Inventory Records

Lesson 17

Annual Evaluation Plan

Lesson 18

Fiscal Essentials: CFCC Contract Type

Lesson 19

Fiscal Essentials: CCTR Contract Types

Introduction to Reimbursement

Contracts are reimbursed in monthly apportionment amounts, which are determined by Child Development Fiscal Services (CDFS) according to projected earnings calculated from the contractor’s Enrollment, Attendance, & Fiscal Report data.

Reference

Watch Video Lesson ❯

Sample Forms/Tools ❯

Review Sketch Pad Notes ❯

Reporting Deadlines

Contractors are required to submit monthly or quarterly attendance & fiscal reports depending upon their contract.

Monthly reporting is required for “Contractors on conditional or provisional status”. For all other contractors, attendance reports are submitted quarterly for the periods ending.

Reports are due by the 20th of the month following the end of the reporting period. Attendance data is submitted online within the Child Development Program Enrollment Attendance and Fiscal Reporting System (CDPR).

Reports NOT received or that are incomplete are delinquent & apportionments will be withheld.

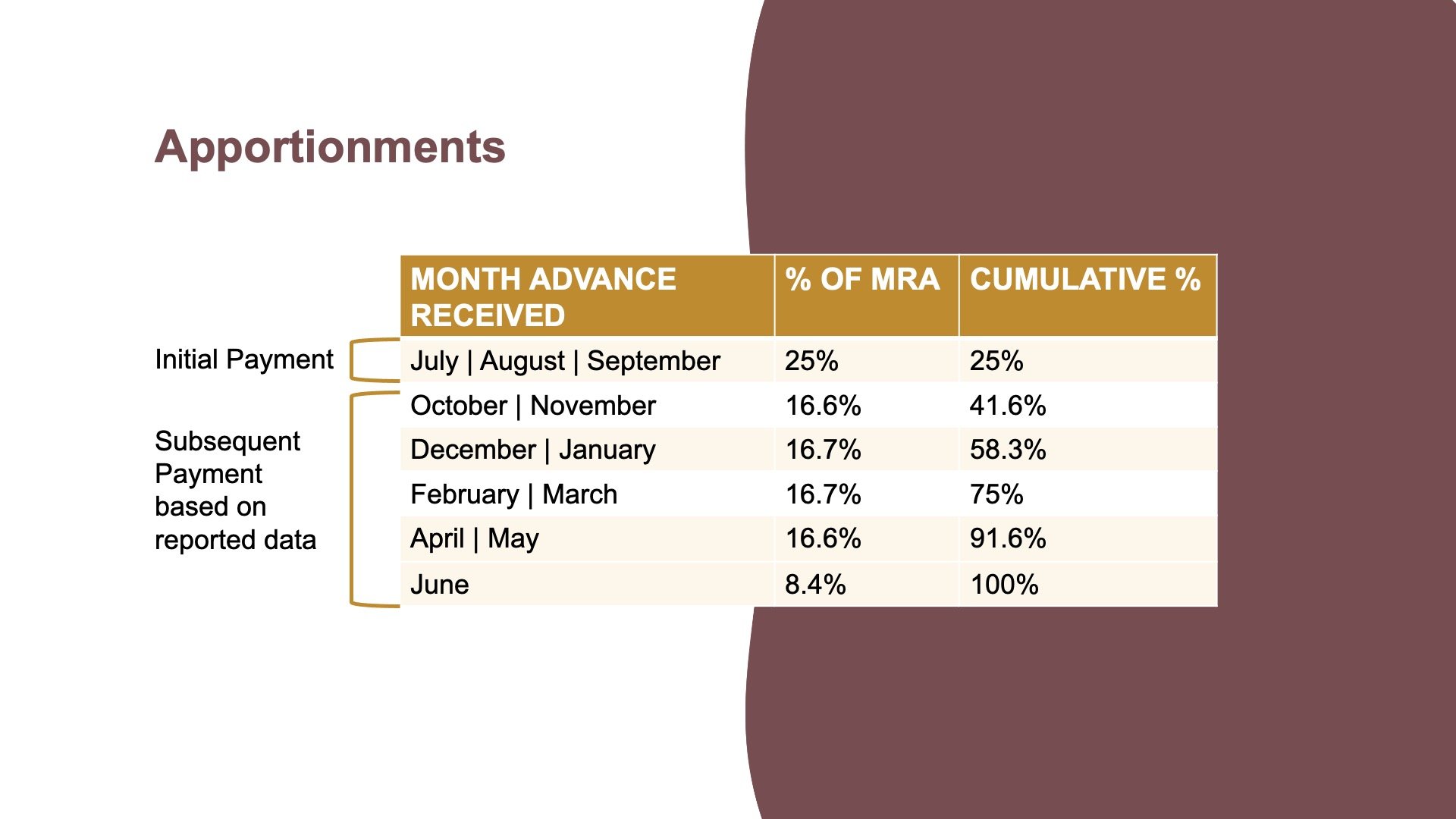

Apportionments

Advance apportionments are issued to contractors on a monthly basis determined by the Child Development Fiscal Services (CDFS) according to projected earnings calculated from the contractor’s Enrollment, Attendance & Fiscal Reports data submitted through CDPR.

After initial payment, subsequent payments are based on reported data in CDPR.

To determine the payment, the contract earnings are multiplied by the maximum cumulative % applicable for that month or months, minus any apportionments paid to date.

Contractors will receive funds via FoundationCCC through electronic fund transfer or paper checks.

Limits of Reimbursement

For Fiscal Year 2023-2024, contractors will be reimbursed on the lessor of the 2 limits of reimbursement so long as conditions are met:

Contract Maximum Reimbursable Amount, or

Net Reimbursable Program Costs

Beginning July 1, 2025, contractors are reimbursed based on the 3 limits of reimbursement:

Contract Maximum Reimbursable Amount

Net Reimbursable Program Costs

Service Earnings

Notification Letters

After reports are submitted by the agency, Fiscal Services provides a notification letter along with earning calculation worksheet regarding the upcoming apportionment:

Preliminary Review Letter: Sent to contractors who are projected to earn their contract

Apportionment Adjustment Letter: Sent to contractors whose apportionment is reduced because the contractor is not projected to fully earn the MRA; also serves as a warning of potential fiscal or enrollment issues

Apportionment Withhold Letter: Sent to contractors whose apportionment is entirely withheld due to noncompliance with contract requirements

NOTE: Regardless of the letter received, contractors should carefully review the earnings calculations worksheet to address any possible overspending or enrollment problems & make adjustments as needed.

Year-End Calcuation

Year-end reports are calculated at the end of the Fiscal year to determine a contract’s total reimbursement. The year-end calculation may result in one of the following:

No additional payments due to the contractor if the contractor fully earned the contract

Calculated billing due to over-advancement of contract funds as a consequence of not earning the contract

If the year-end calculation results in a billing, the contractor will receive a Preliminary Billing Notification along with the calculation worksheet.

What this might look like in a program:

Upon notification of a calculated billing, the contractor should review the previously submitted report data for accuracy.

Ensure any approved Emergency Closures are included within your reports.

Complete Knowledge Check ❯

After reviewing the video lesson & sketch pad notes, it’s time to check for understanding by completing a Knowledge Check. Note that Individual Knowledge Checks will conclude with a Certificate.