Lesson

Dashboard

Lesson 1

Family Selection

Lesson 2

Family Data File

Lesson 3

Attendance

Lesson 4

Parent Involvement & Education

Lesson 5

Health & Social Services

Lesson 6

Site Licensure & License Exempt

Lesson 7

Staff-Child Ratios

Lesson 8

Classroom Assessment System

Lesson 9

Nutritional Needs

Lesson 10

Desired Results Profile & Data

Lesson 11

Qualified Staff & Director

Lesson 12

Staff Development Program

Lesson 13

Refrain from Religious Instruction

Lesson 14

Inventory Records

Lesson 15

Annual Evaluation Plan

Lesson 16

Fiscal

Compliance

Indicator

The program has submitted fiscal attendance and accounting reports to the CDE consistent with the laws for state or federal fiscal reporting and accounting, including the set-aside for enrollment of children with disabilities.

Regulations/Reference

EED Program Instrument: V. Fiscal EED 23

Education Code: 8202, 8208, 8231, 8232 & 8247

Title 5: 17821

Fiscal Handbook: Enrollment, Attendance, & Fiscal Reporting, & Reimbursement Procedures for Early Education Contracts

Monitoring Review Evidence

Child Development Fund

Fiscal Attendance & Accounting Reports

Set-Aside for Children with Disabilities (Exceptional Needs)

Watch Video Lesson ❯

Sample Forms/Tools ❯

Review Sketch Pad Notes ❯

California Preschool Accounting Reporting Information System (CPARIS)

Attendance data is submitted online within the California Preschool Accounting Reporting Information System (CPARIS). CPARIS is the web-based system through which state preschool programs, submit required enrollment, attendance & fiscal reports.

To support contractors with entering fiscal & attendance data into CPARIS, the user manual provides instructions on how to navigate the web-based platform.

Prior to submitting the first Enrollment, Attendance & Fiscal report of the fiscal year, contractors must submit the certification of assurances.

Attendance reports applicable to your contracts may be found on CPARIS within the reporting tab that is broken down into two subcategories:

Current Forms: reports that are currently due

All Report Forms: reports that are open, available for editing, have upcoming deadlines, are certified, and/or overdue for being certified

The Enrollment, Attendance & Fiscal Report is separated into three sections:

Enrollment & Attendance: Report data by county

Fiscal: Report at contract level

Finalize Calculations: Summary

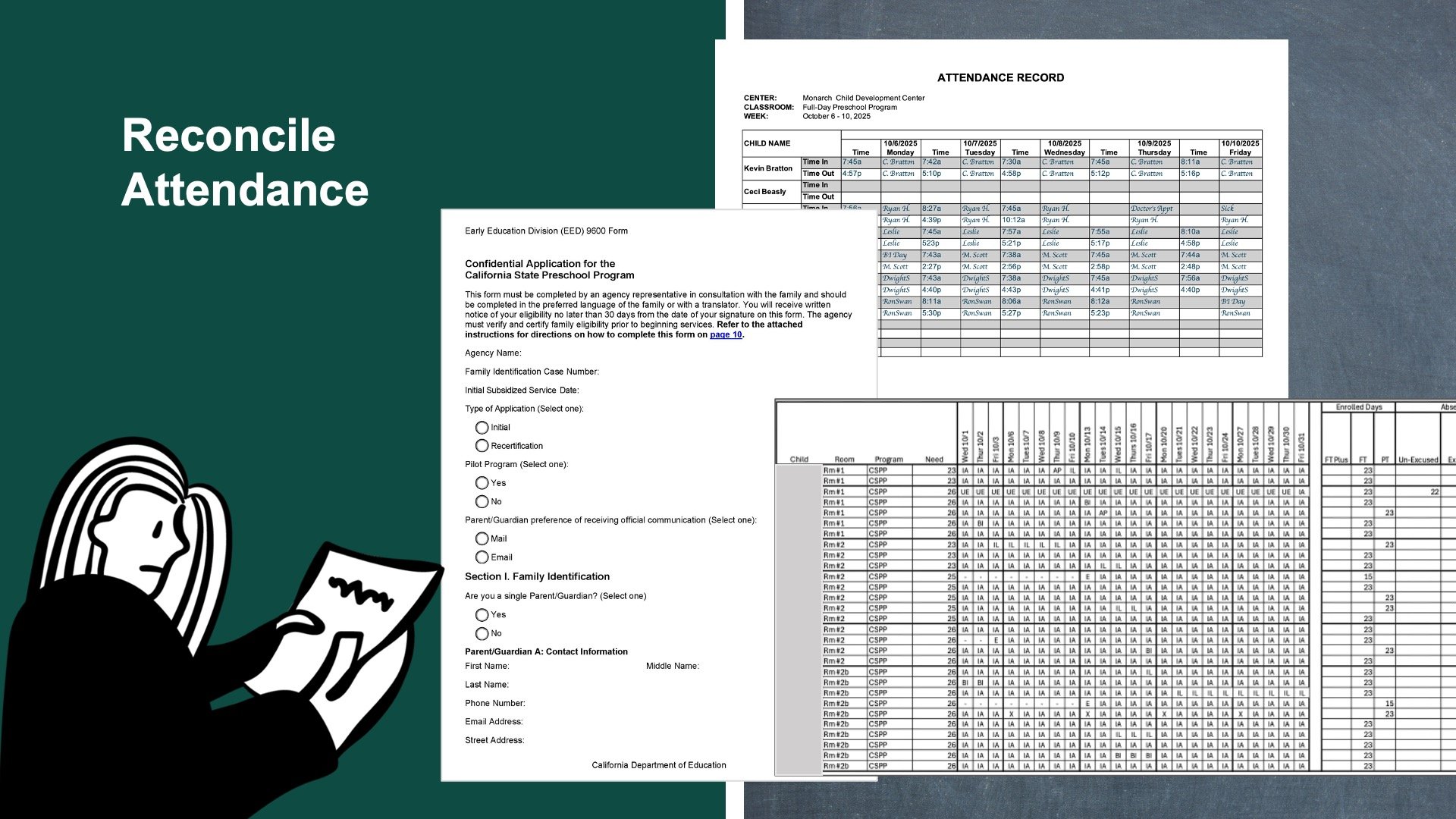

Reconcile Attendance Records

Attendance should be reconciled monthly using the following steps:

Take original sign in & out records

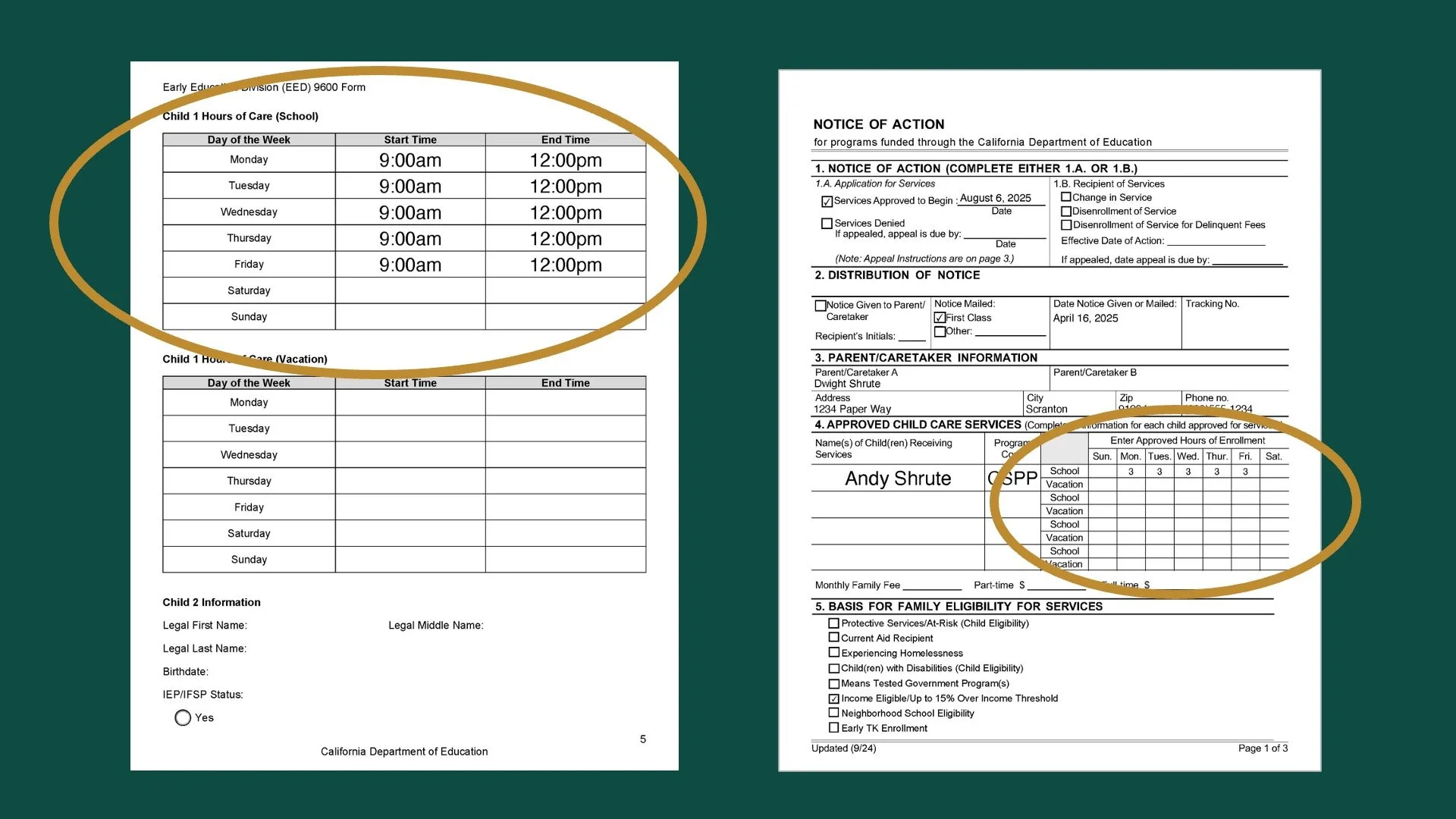

Along with certified attendance as documented on the Notice of Action & Application for Services

Reconcile into a monthly attendance report that is broken down by child, room, program, adjustment factor code & days of attendance, along with any absences. The data is then rolled up to reflect the total enrolled days for the month.

NOTE: All 3 of these documents will serve as your back-up documentation for the attendance & fiscal report that will be submitted to Fiscal Services.

Attendance Reporting

Contractors are required to submit monthly or quarterly attendance depending upon their contract. Monthly reporting is required for “Contractors on conditional or provisional status” For all other contractors, attendance reports are submitted quarterly. Reports are due by the 20th of the month following the end of the reporting period.

Once at least one enrollment, attendance and fiscal report has been certified, cumulative prior period data from that report, by service county and category, will auto-populate in the Enrollment & Attendance Section.

Certified & Non-Certified Children

Within CPARIS, Data for both certified & non-certified children must be entered into different tables. Within the certified tables, report only days of enrollment for children certified as eligible for the State Preschool Program.

A family is considered to be certified for enrollment when the application for services & certification forms have been completed, information has been verified, and forms have been signed.

Non-certified children are children that were provided services in the same classroom at the same time as the certified children. These are children supported by another funding source. These are children not subsidized by the contractor’s CDE or CDSS contract.

If the program does not serve non-certified children, select NO to turn off the table. If no is not marked, you must complete & submit this section of the report or it may be considered incomplete & delinquent.

Special Criteria Factors

Special criteria factors recognize that different categories of children require special care or services and that the costs for these services vary.

Adjustment factors are used to change actual enrollment to Adjusted Days of Enrollment, which will result in higher service earnings.

Reporting within the age adjustment factor categories is based on the statutory age definition.

A child whose 3rd birthday is on or before December 1st of that fiscal year is statutorily 3 years old and must be reported within the two years old and three years old category

A child whose 4th birthday is on or before December 1st of that fiscal year is statutorily 4 years old and shall be reported within the 4 years and older category.

NOTE: Effective fiscal year 24-25 through fiscal year 26-27, children must be reported within the identified adjustment factor category for the entire fiscal year.

Special Criteria Adjustments include:

Child with a Disability

Dual Language Learner

At Risk of Abuse or Neglect

Severely Disabled

Mental Health Consultation Services (MHCS)

Note: To claim the special criteria adjustment factor for a child with a disability or “severely disabled”, the child must have an active Individualized Educational Program (IEP) or Individual Family Service Plan (IFSP)

Once the correct category is determined, each category is further broken down based on the number of hours a child is enrolled for. There are 3 different time based designations that determine the adjustment factor:

Full-time: Child’s certified schedule is 25 hours total or more per week

Part-time: Child’s certified schedule is less than 25 hours total per week

Full-time Plus: Must be reported for any individual day child is enrolled more than 10.5 hours

What this might look like in a program:

Unlike prior years, contractors will no longer report a child in the four-year-old adjustment factor category on the child’s fourth birthday. The contractor must continue reporting the child in the two years old and three years old adjustment factor category for the entire fiscal year.

For example, Andy enrolls in your program for fiscal year 25-26. Since his 3rd birthday is before December 1st of that fiscal year, he is statutorily 3 years old and will remain in the two years old and three years old reporting category for the remainder of the fiscal year. He would not be moved to the 4 years and older category on or after his birthday.

Data Inputting

Once attendance records have been reconciled, within CPARIS input the data into the applicable category.

For the first report of the fiscal year, use only the Current Period column to enter enrollment data & beginning with the second report and those thereafter, cumulative prior report data will automatically be carried forward into the Cumulative Prior Period column.

Note: Do not use negative figures in any of the columns.

For all categories entered, the total days of enrollment will automatically calculate once recalculate or save is selected.

Child days of enrollment, is the total of every child’s enrollment for the days the contractor is open to provide services. Enrollment for each child depends on certified enrollment which is reflected on the Notice of Action.

In a typical year, child days of attendance, known as CDA are the total days that certified children are present in the program for any part of a day for which they are enrolled or if they have excused absences.

Basically, you would take the child days of enrollment and subtract any days of unexcused absences, which would then equal the child days of attendance.

Beginning July 1st, as we move from a hold harmless year to a typical year, it is important to keep an eye on the difference between your child days of enrollment and attendance. There is a five percent flex factor for attendance. Child days of attendance below 95% of the child days of enrollment will affect your service earnings.

Complete Knowledge Check ❯

After reviewing the video lesson & sketch pad notes, it’s time to check for understanding by completing a Knowledge Check. Note that Individual Knowledge Checks will conclude with a Certificate.