Lesson

Dashboard

Lesson 1

Family Selection

Lesson 2

Family Data File

Lesson 3

Attendance

Lesson 4

Parent Involvement & Education

Lesson 5

Health & Social Services

Lesson 6

Site Licensure & License Exempt

Lesson 7

Staff-Child Ratios

Lesson 8

Classroom Assessment System

Lesson 9

Nutritional Needs

Lesson 10

Desired Results Profile & Data

Lesson 11

Qualified Staff & Director

Lesson 12

Staff Development Program

Lesson 13

Refrain from Religious Instruction

Lesson 14

Inventory Records

Lesson 15

Annual Evaluation Plan

Lesson 16

Contract/Fiscal

Introduction to

Reimbursement

Contracts are reimbursed in monthly apportionment amounts, which are determined by Early Education Nutrition Fiscal Services (EENFS) according to projected earnings calculated from the contractor’s Enrollment, Attendance, & Fiscal Report data.

Reference

Fiscal Handbook: Enrollment, Attendance, & Fiscal Reporting, & Reimbursement Procedures for Early Education Contracts

Watch Video Lesson ❯

Sample Forms/Tools ❯

Review Sketch Pad Notes ❯

Reporting Deadlines

Contractors are required to submit monthly or quarterly Enrollment, Attendance & Fiscal Reports depending upon their contract.

Monthly reporting is required for “Contractors on conditional or provisional status”. For all other contractors, attendance reports are submitted quarterly for the periods ending.

Reports are due by the 20th of the month following the end of the reporting period. Attendance data is submitted online within the California Preschool Accounting Reporting Information System (CPARIS).

Reports NOT received or that are incomplete are delinquent & apportionments will be withheld.

Reports applicable to your contracts may be found on CPARIS within the reporting tab. Within the Reporting Tab are two subcategories:

Current Forms: contains the reports that are currently due

All Report Forms: contains all report forms that are open, available for editing, have upcoming deadlines, are certified, and/or are overdue for being certified

Prior to submitting the first Enrollment, Attendance & Fiscal Report of the fiscal year, contractors must submit the certification of assurances.

NOTE: To support contractors with entering fiscal & attendance data into CPARIS, the user manual may be found on the Child Development Fiscal Services webpage.

Apportionments

Apportionments are advanced to contractors based on the apportionment schedule. After initial payment, subsequent payments are based on reported data in CPARIS.

To determine the apportionment amount for any particular month:

Contract Earnings x Cumulative Month % – Apportionments Paid to Date = Payment

Contractors will receive funds via FoundationCCC through electronic fund transfer or paper checks.

CPARIS allows contractors to view their apportionment payment detail as well as to collect fiscal and attendance data for preschool contractors.

Limits of Reimbursement

For Fiscal Year 2023-2024 (Hold Harmless Year), contractors will be reimbursed on the lessor of the 2 limits of reimbursement so long as conditions are met:

Contract Maximum Reimbursable Amount, or

Net Reimbursable Program Costs

NOTE: Offering only distance learning services does not qualify as being open & is not reimbursable

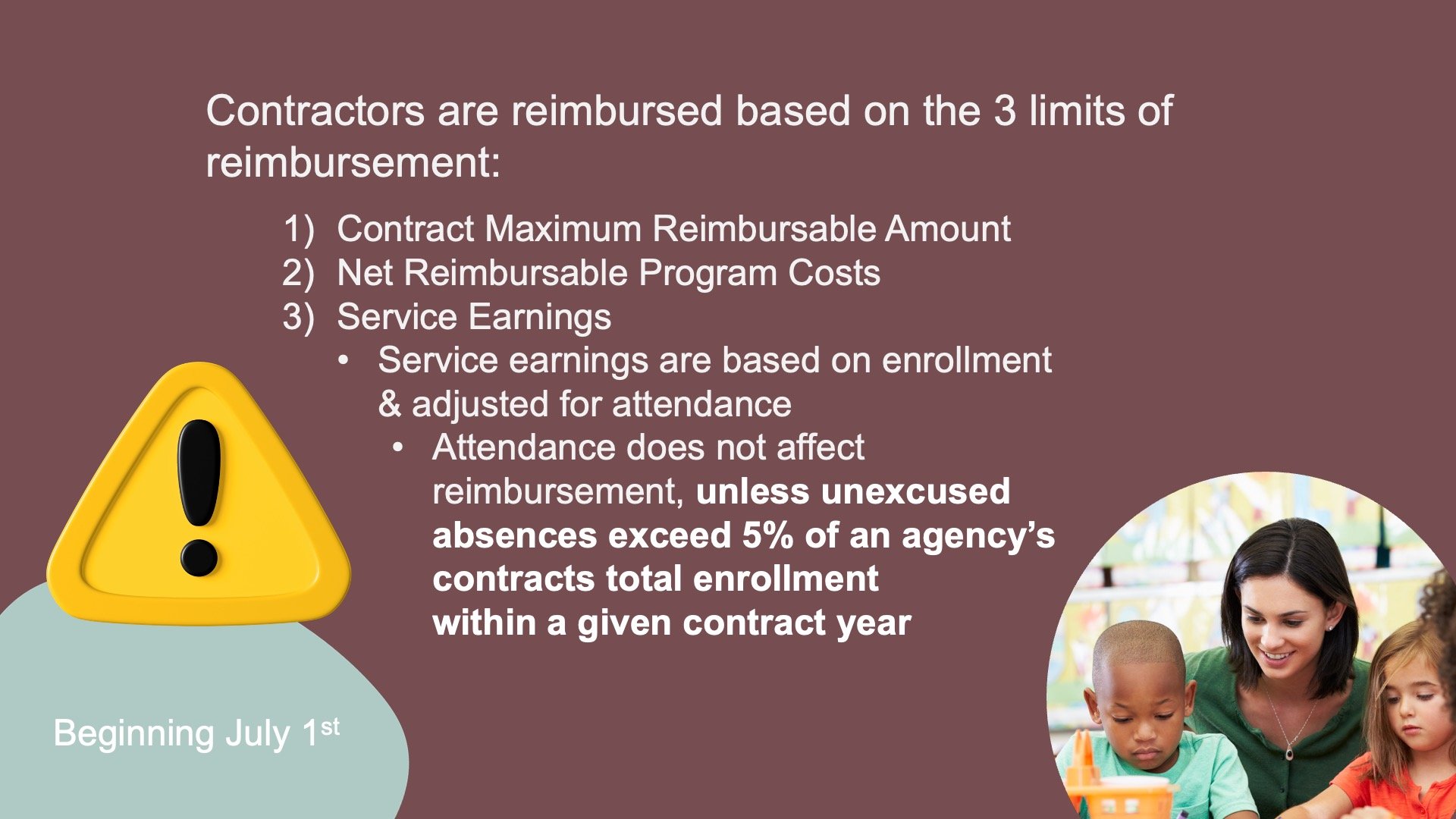

Beginning July 1, 2025, contractors are reimbursed based on the 3 limits of reimbursement:

Contract Maximum Reimbursable Amount

Net Reimbursable Program Costs

Service Earnings

Contractors will need to ensure they closely monitor enrollment, projections, and their ability to secure other funding to cover any additional costs incurred.

What might this look like in a program:

2025-2026 Example:

Scranton Community Action Agency has a Maximum Reimbursable Amount or MRA of $850,000.

The total Service Earnings for the year totaled $800,000 while their Net Reimbursable Expenses totaled $845,000

Based on the above, Scranton will be reimbursed $800,000 as the service earning were less than the maximum reimbursable amount.

The contractor will need to explore other funding sources such as tapping into their reserve account or deferred revenue from unspent set-aside funds to cover the excess expenses of $45,000 that will not be reimbursed.

Exceptional Needs/Severely Disabled Set Aside

State Preschool contractors are required to set aside 5% of funded enrollment for children with exceptional needs.

To calculate the set aside, contractors will multiply the contract MRA by the full-time exceptional needs adjustment factor of 2.4 and again by 5%.

The CDE will determine the extent to which contractors are earning their set aside amount based on child days of enrollment reported under the exceptional needs & severely disabled adjustment factor category within the Enrollment, Attendance and Fiscal report.

Contractors who are not fully earning their set-aside will be given a service-level exemption credit to be reimbursed for identified expenses without meeting the service requirement.

NOTE: This would be the difference between the contract set-aside amount and the actual exceptional needs and severely disabled service earnings.

Notification Letters

After reports are submitted by the agency, Fiscal Services provides a notification letter along with earning calculation worksheet regarding the upcoming apportionment:

Preliminary Review: Contractors are projected to earn

Apportionment Adjustment: Contractors are projected to under earn & apportionment is reduced

Apportionment Withhold: Apportionment is entirely withheld due to noncompliance

NOTE: Regardless of the letter received, contractors should carefully review the earnings calculations worksheet to address any possible overspending or enrollment problems & make adjustments as needed.

Notification letters & the Earning Calculation Worksheet may be found within CPARIS.

Year-End Calcuation

Year-end reports are calculated at the end of the Fiscal year to determine a contract’s total reimbursement. The year-end calculation may result in one of the following:

No additional payments due to the contractor if the contractor fully earned the contract

Calculated billing due to over-advancement of contract funds as a consequence of not earning the contract

If the year-end calculation results in a billing, the contractor will receive a Preliminary Billing Notification along with the calculation worksheet.

What this might look like in a program:

Upon notification of a calculated billing, the contractor should review the previously submitted report data for accuracy.

Ensure any approved Emergency Closures are included within your reports.

Complete Knowledge Check ❯

After reviewing the video lesson & sketch pad notes, it’s time to check for understanding by completing a Knowledge Check. Note that Individual Knowledge Checks will conclude with a Certificate.