Lesson 5

Provider Reimbursement

Compliance Indicator

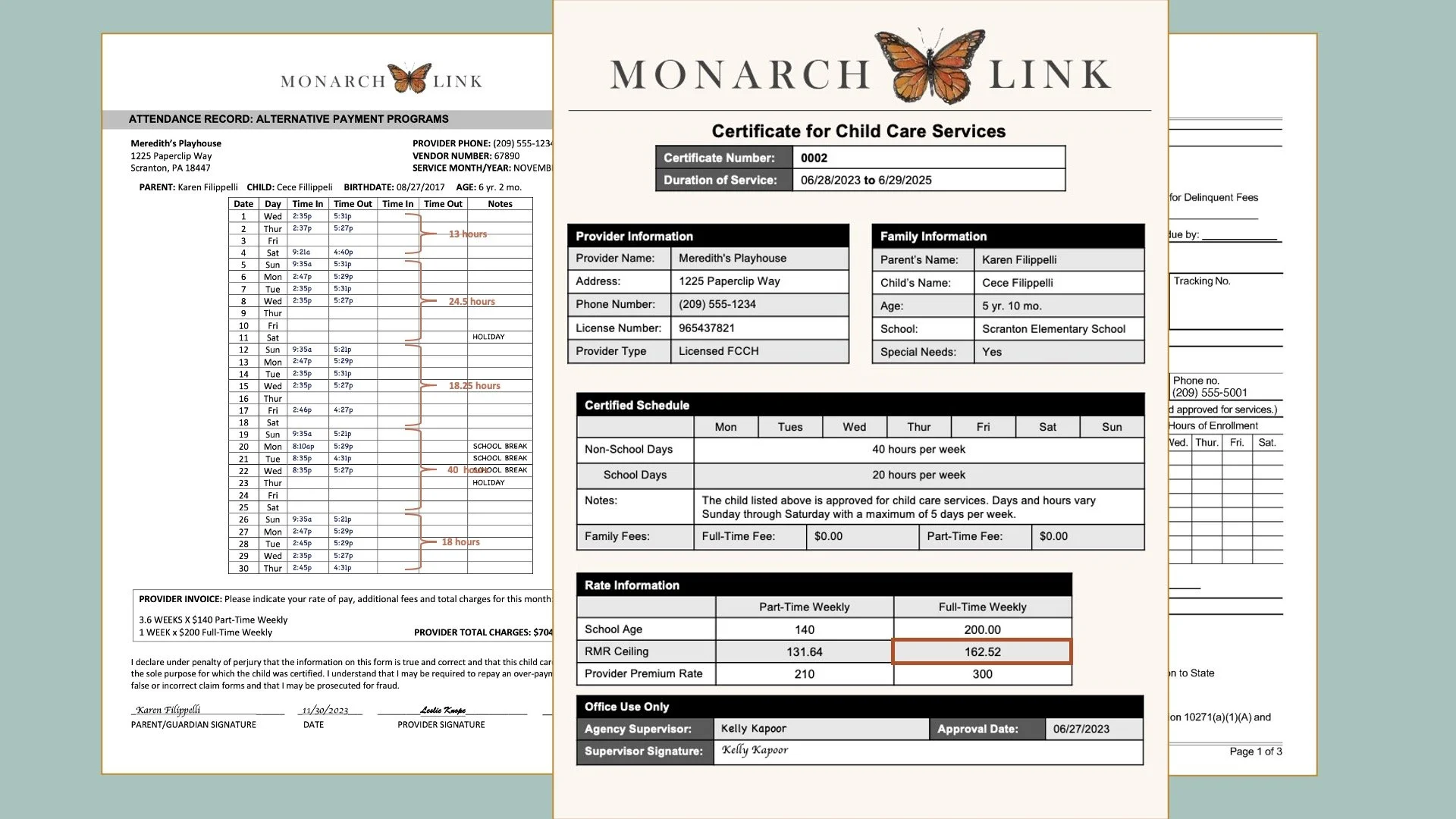

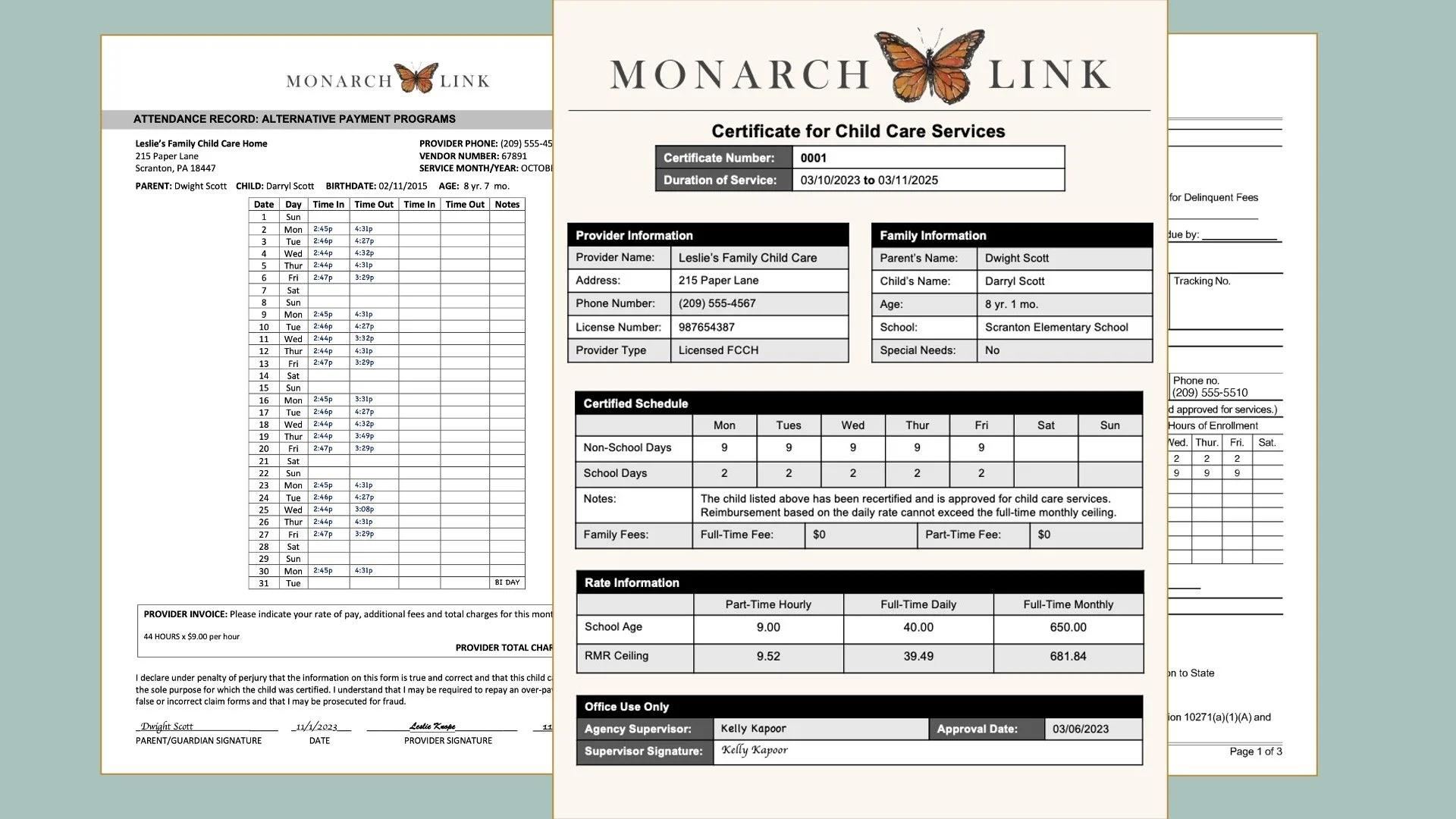

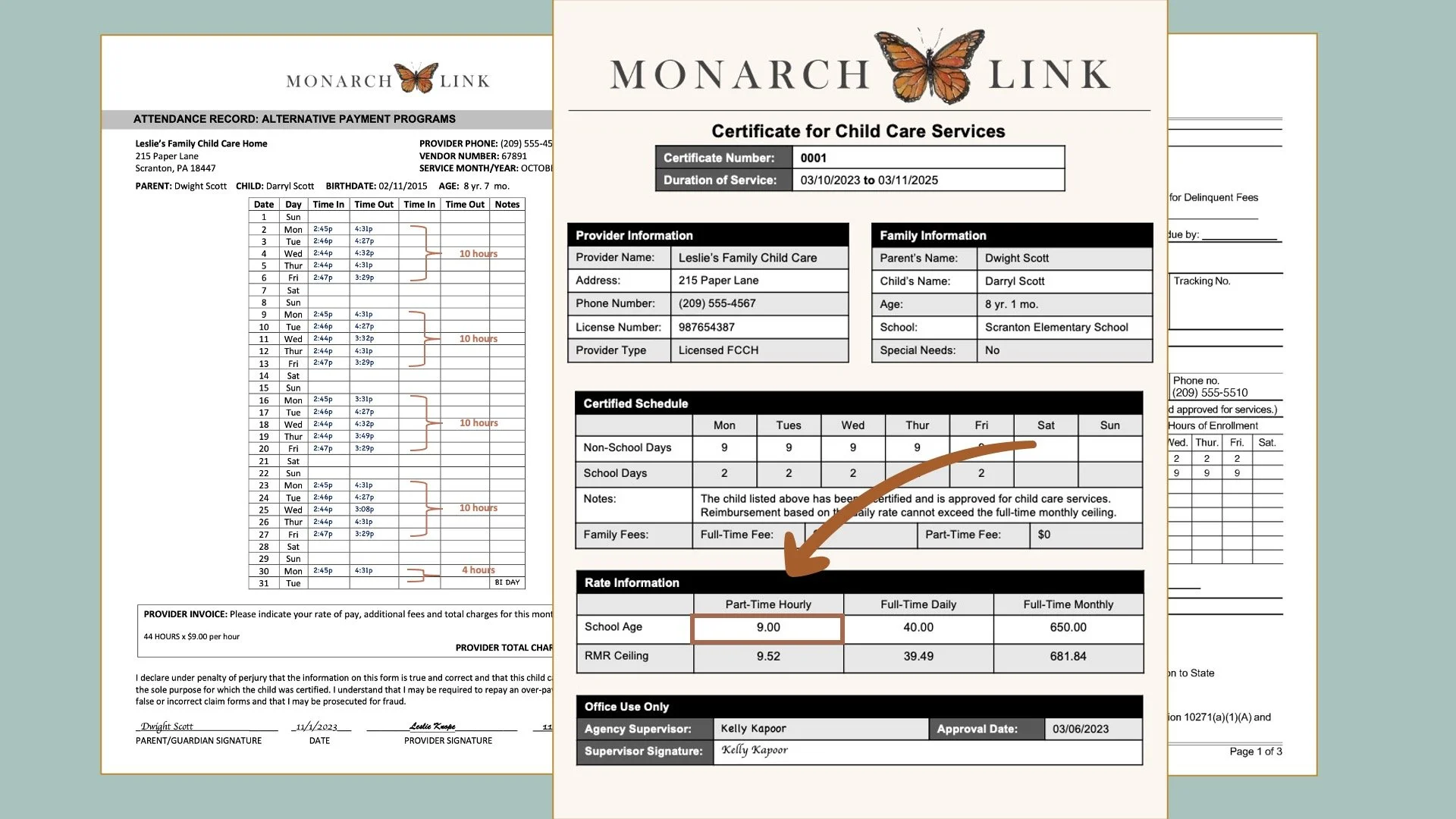

Contractors must reimburse providers using the appropriate RMR based on the age of the child, certified need for child care, and the facility type. Contractors are to select the rate category which most closely aligns with providers’ customary rates while remaining in compliance with regulations.

APPs must reimburse providers according to applicable the categories in 5 CCR Section 18075 and cannot unilaterally eliminate rate categories (such as hourly, daily, part-time weekly, full-time weekly, part-time monthly or monthly rates) from consideration.

Regulations/Reference

CCD Program Instrument: I. Family Files CCD 06a

Welfare & Institutions Code: 10228,10231.5, 10271(h)(3), 10277, 10280, 10426.5

Title 5: 18074-18074.6, 18075, 18075.1, 18076.1, 18076.2, 18084.2, 18226, 18228

Monitoring Review Evidence

Provider Documentation of Childcare Certificate

Provider Rates

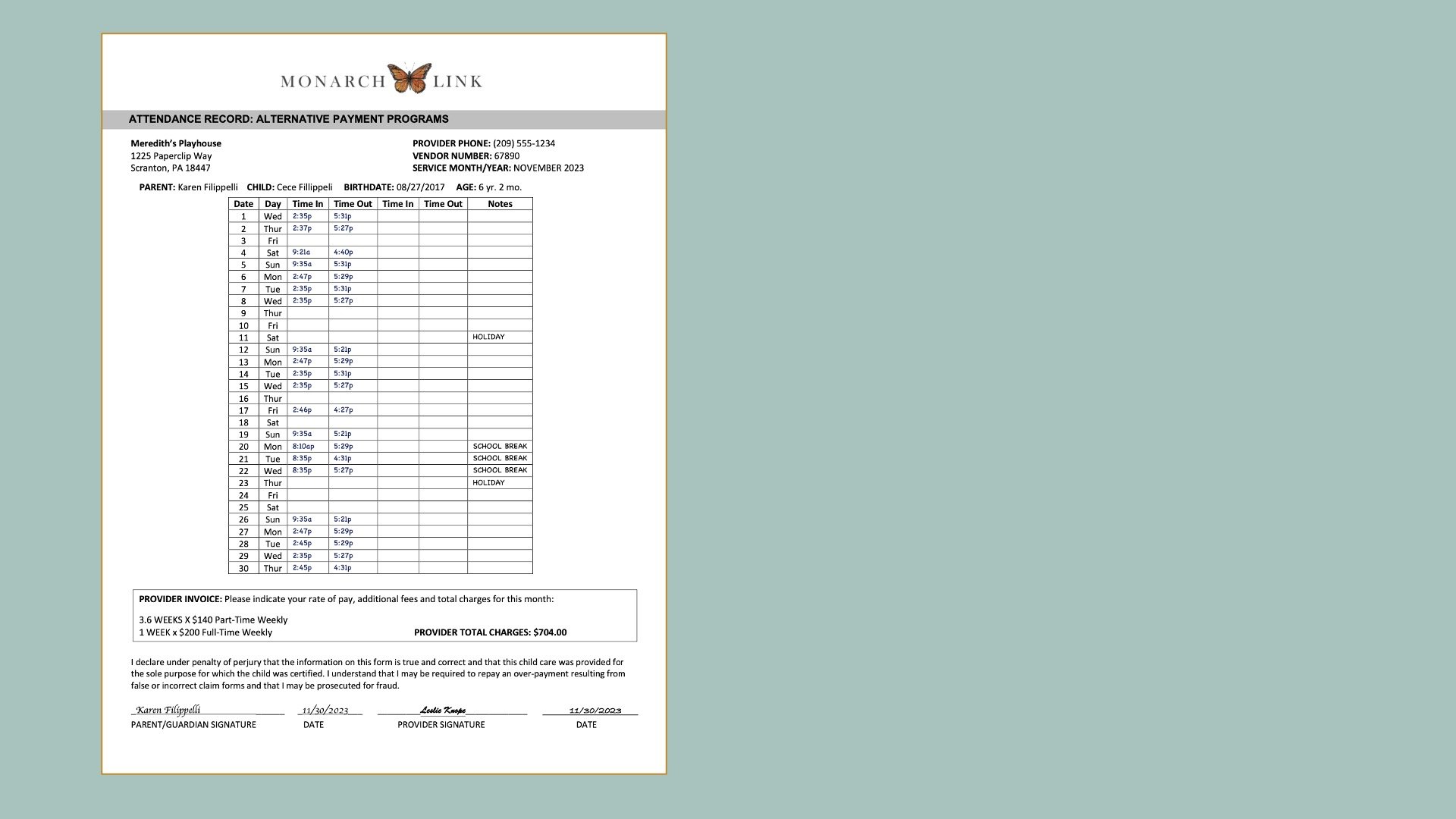

Sign-in/Sign-out Records/Invoice

Provider Payment

Review that payments were made within 21-day timeline consistent with the Timely Provider Payment Plan on file

Written Materials to Parents

Watch Video Lesson ❯

Sample Forms/Tools ❯

Review Sketch Pad Notes ❯

Plan for Provider Reimbursement

The regulations state that contractors must develop & implement a plan for timely payment to providers. The plan must include:

Providers be reimbursed within 21 calendar days of receipt of complete attendance record or invoice

Schedule for the payment of services signed by provider

Provision that if provider submits attendance records or invoices for multiple children, payments will not be withheld for records that do include adequate information to provide payment

Procedures to resolve overpayment & underpayment issues that include provider written consent to recover any overpayment

Provision that if unable to make payment within 21 calendar days due to extenuating circumstances, the impacted provider will be notified promptly once county or contractor becomes aware of the circumstance causing the delay of reimbursement payment

NOTE: Extenuating circumstances include, but are not limited to, an emergency or payment system malfunction

The plans must be published in documents available to providers, such as handbooks and individual provider agreements.

What this might look like in a program:

An agency might have an electronic data management system to scan & date stamp attendance records as they are submitted into your agency to ensure reimbursement timelines are met.

Reimbursable Care

Through June 30, 2025, APP providers will be reimbursed based on the family’s maximum certified need rather than attendance. When a provider’s documentation states that absences are charged to non subsidized families too, some absences may be reimbursed, such as:

Excused absences: unlimited

Non-operational provider days: limited to 10 days per child per fiscal year

Alternate provider days: limited to 10 days per child per fiscal year

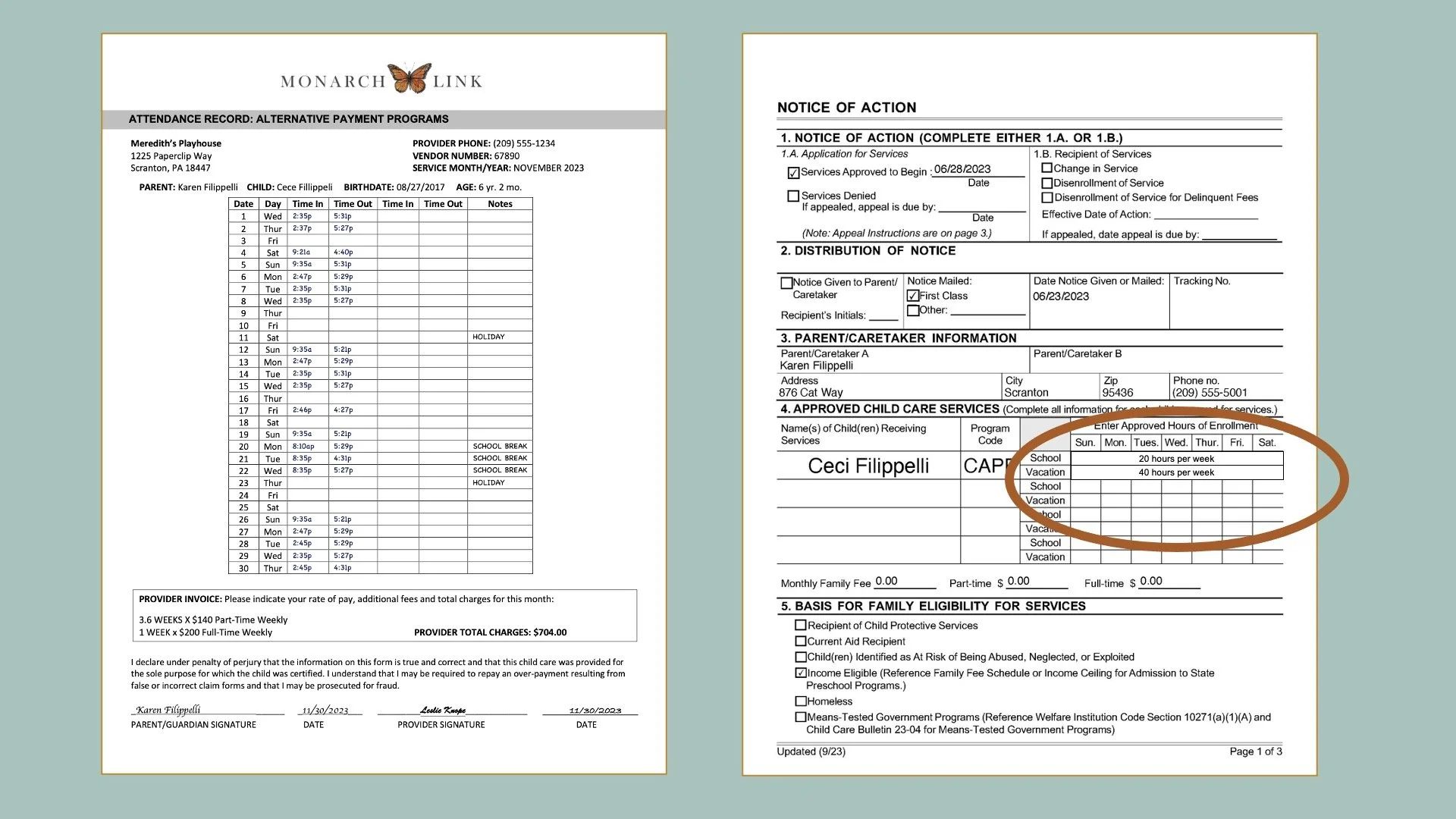

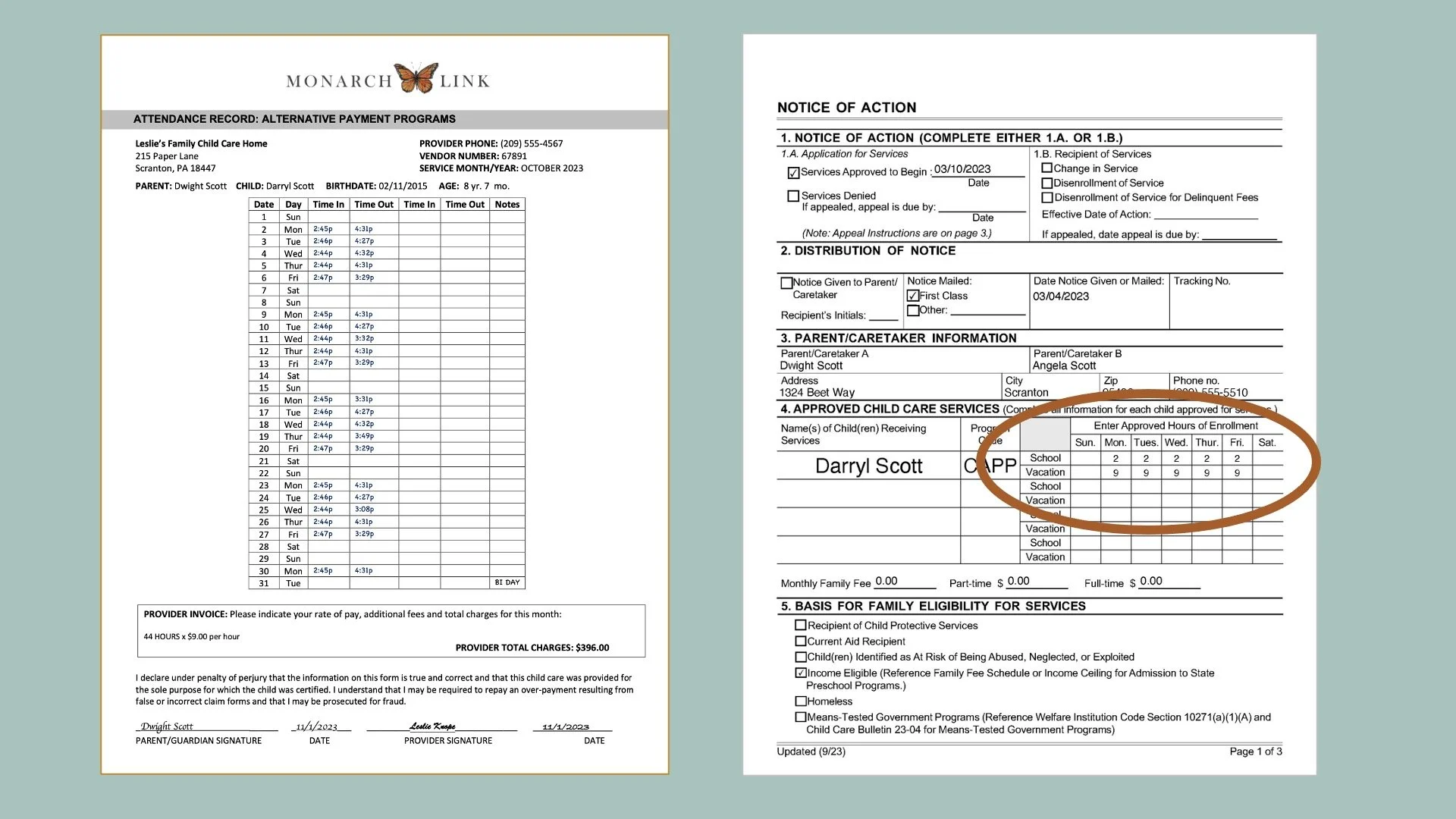

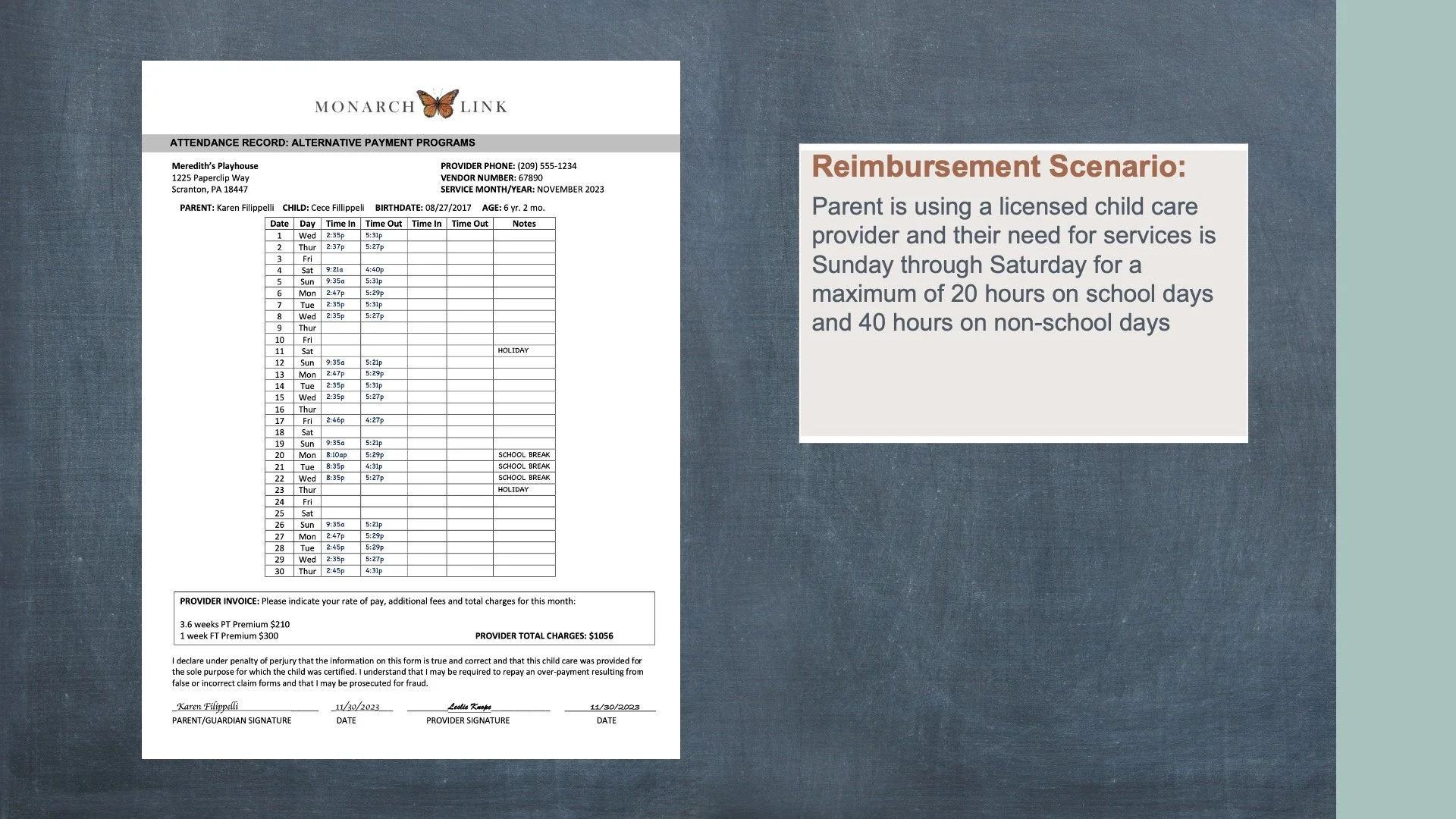

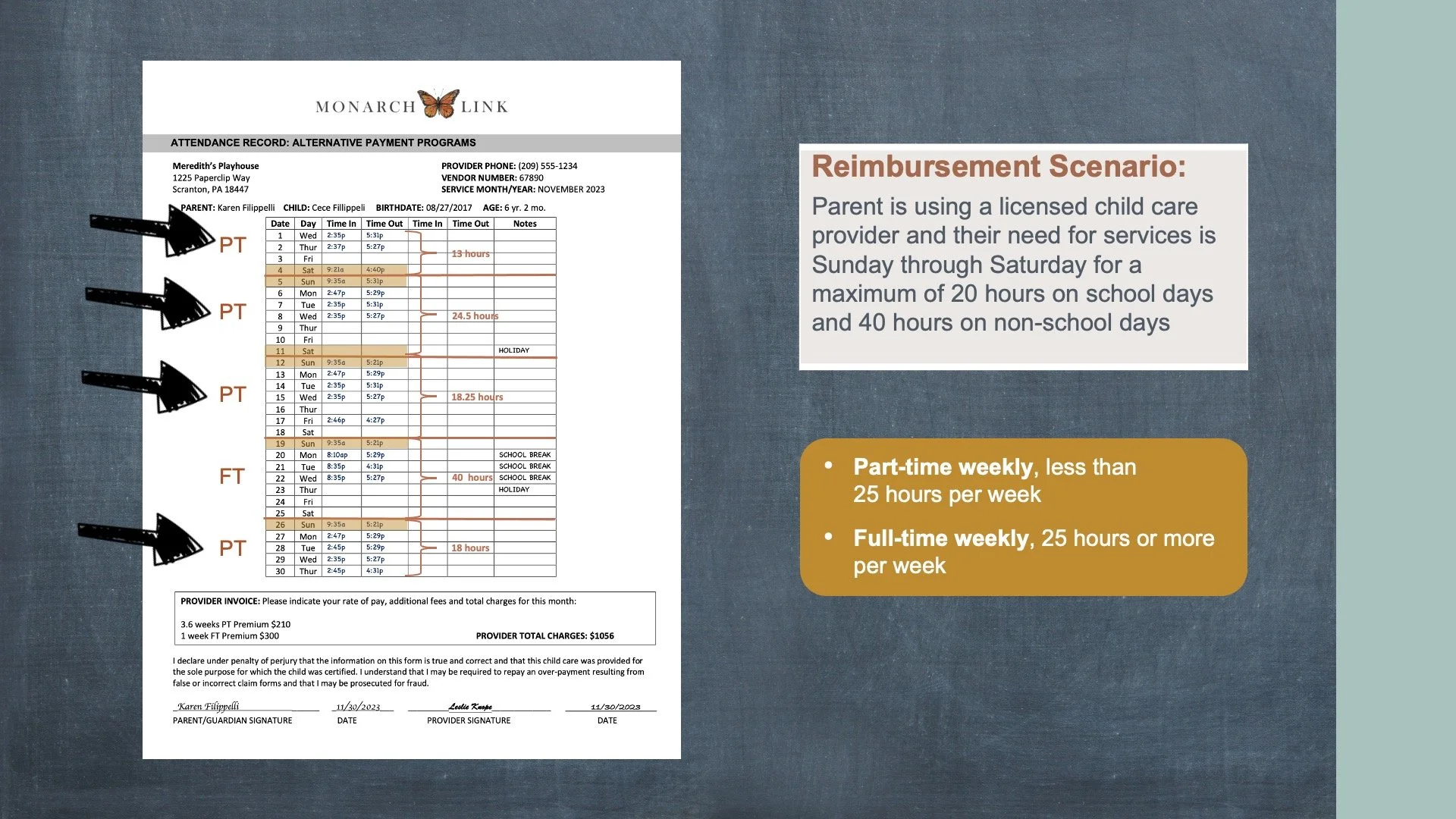

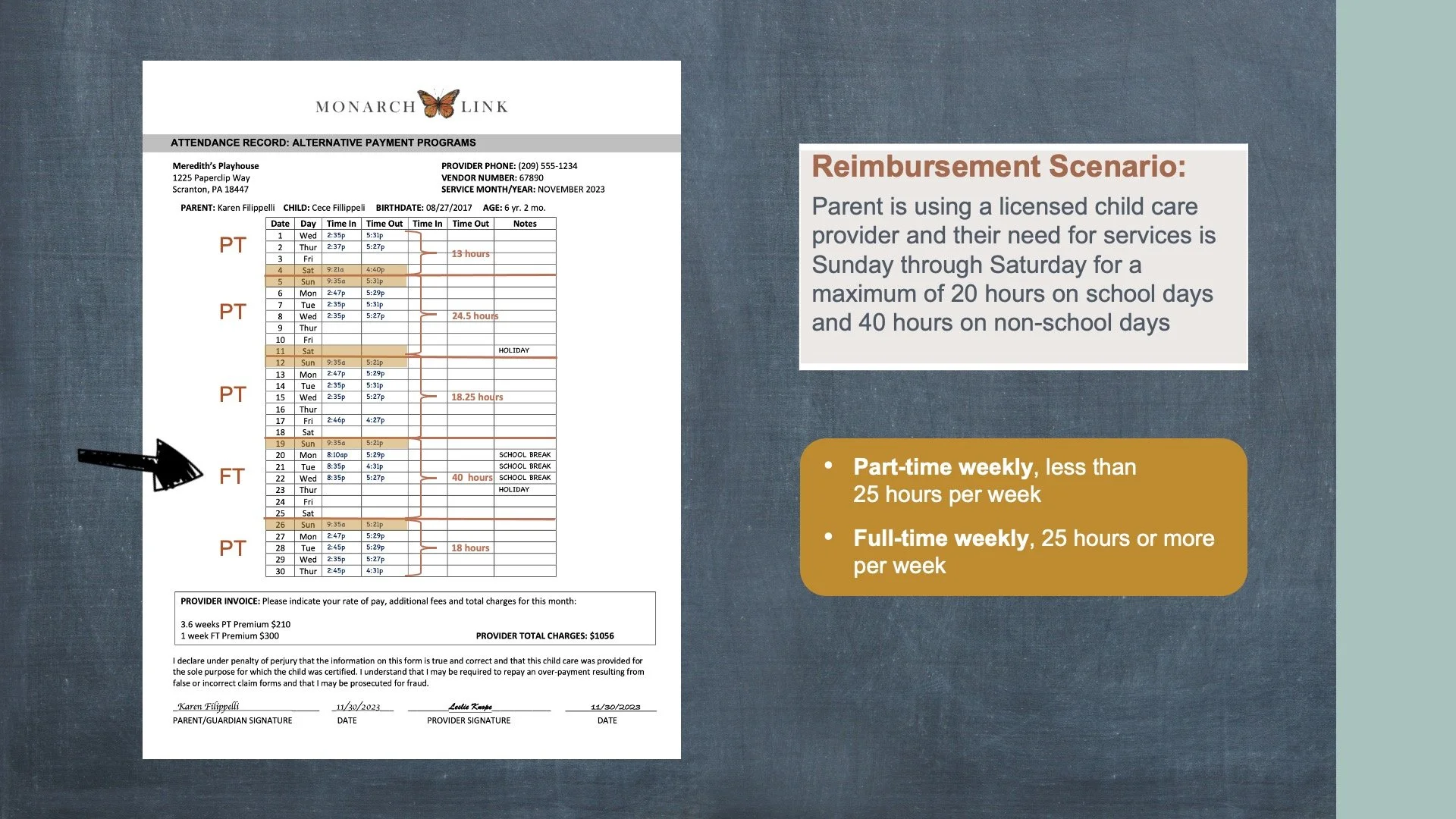

When a parent has consistent certified days and hours of care, reimbursement to both a licensed and license-exempt provider is based on the family’s maximum authorized hours of care.

When a parent has a variable schedule, reimbursement is based on the family’s maximum authorized hours of care.

What this might look like in a program:

Contractors develop a system to track & monitor reimbursable care that is limited to ensure overpayment does not occur.

Any change to the certified need must be based upon a request by the parent & communicated in writing to the provider on the same day as family Notice of Action.

Non-Reimbursable Care

Reimbursable care does not include:

Scheduled instructional minutes for a school aged child

Time when the child is receiving any other child care & development services

When a provider is not open (except for the 10 non-operational days)

Effective November 15, 2021, for school-age children, contractors must only reimburse providers during non-school hours when a school-age child is enrolled and participating in in-person instruction or for days/hours that a school-age child is participating in distance learning while in a child care setting only when the child’s school is closed and in-person instruction is not available.

NOTE: Reimbursement may not be issued to providers for any days/hours of care that take place when in-person instruction is available, but the parent opts to enroll their school-age child in remote learning.

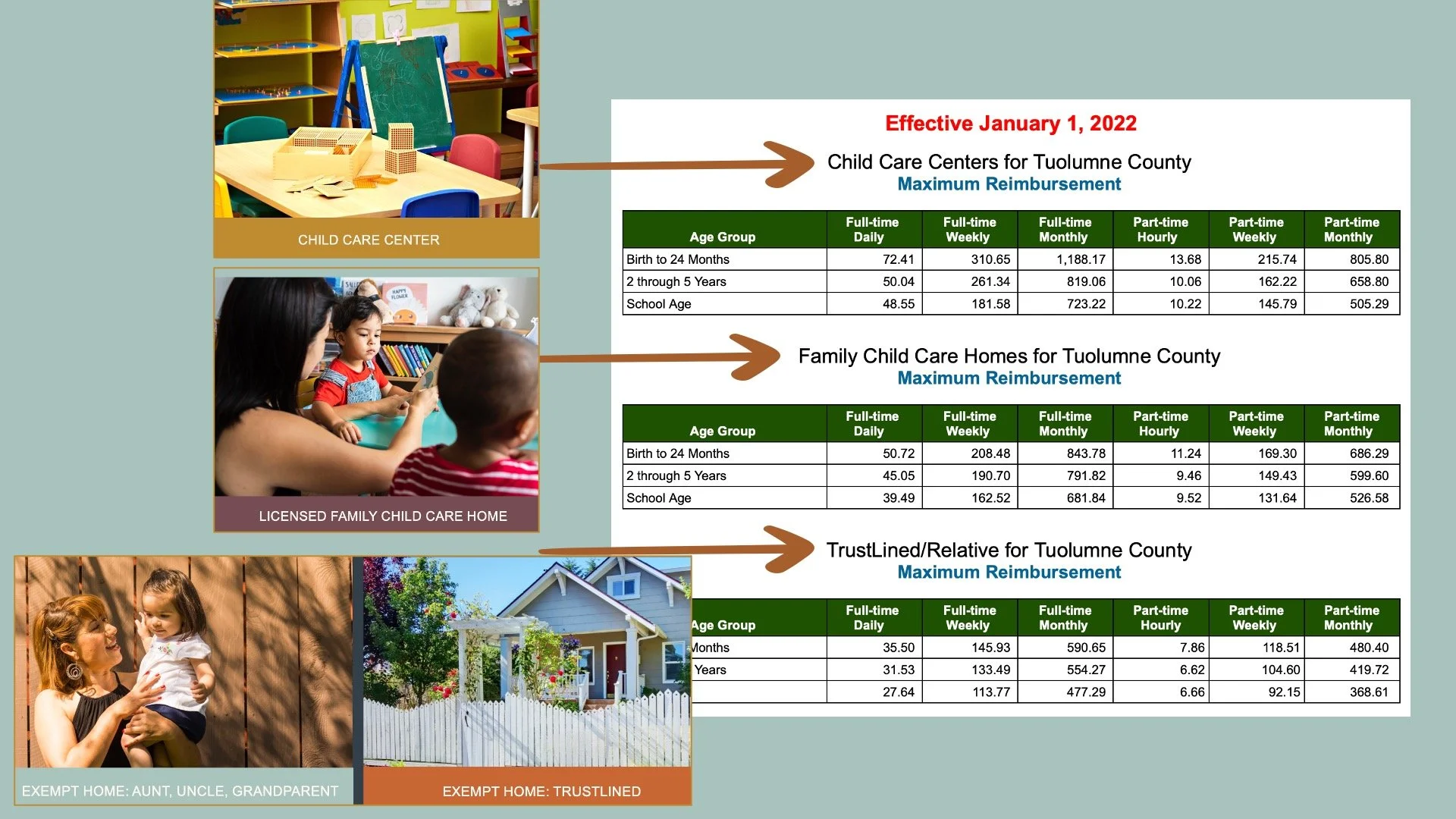

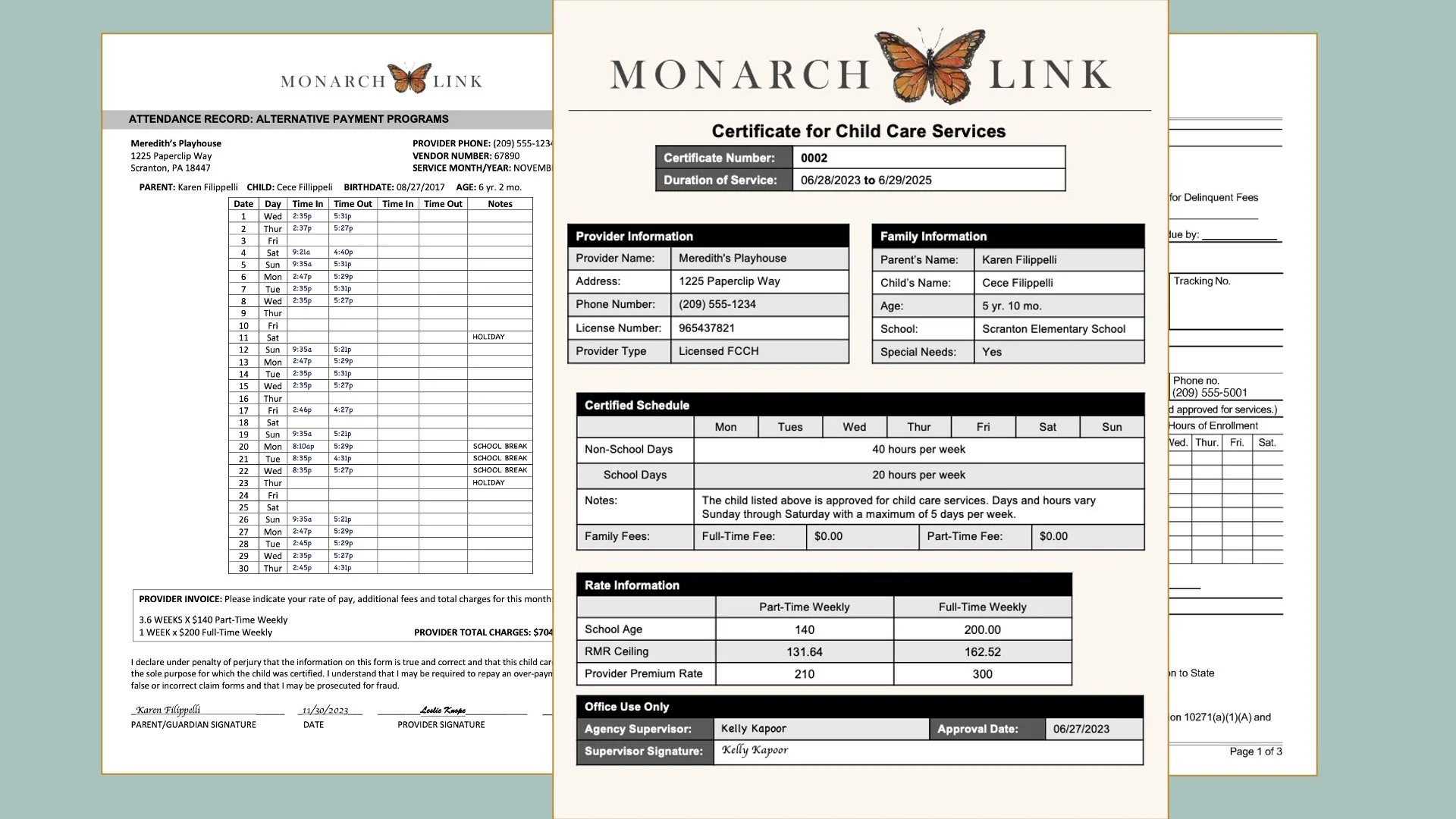

Regional Market Rate (RMR)

To determine a providers reimbursement, agencies must utilize the Regional Market Rate (RMR) ceiling rules. Each county has a different reimbursement ceiling.

When applying the RMR, agencies use the following:

Age of the child: The age groups are broken down by Birth to 24 Months, 2 through 5 years of Age & School Age (6+)

Facility type: The facility types are broken down by Child Care Centers, Family child care homes & Trustline/Relative

Certified need for child care: Depending on the parent’s certified hours, determine if hourly, weekly or monthly would be the most appropriate

Reimbursement Rate Categories

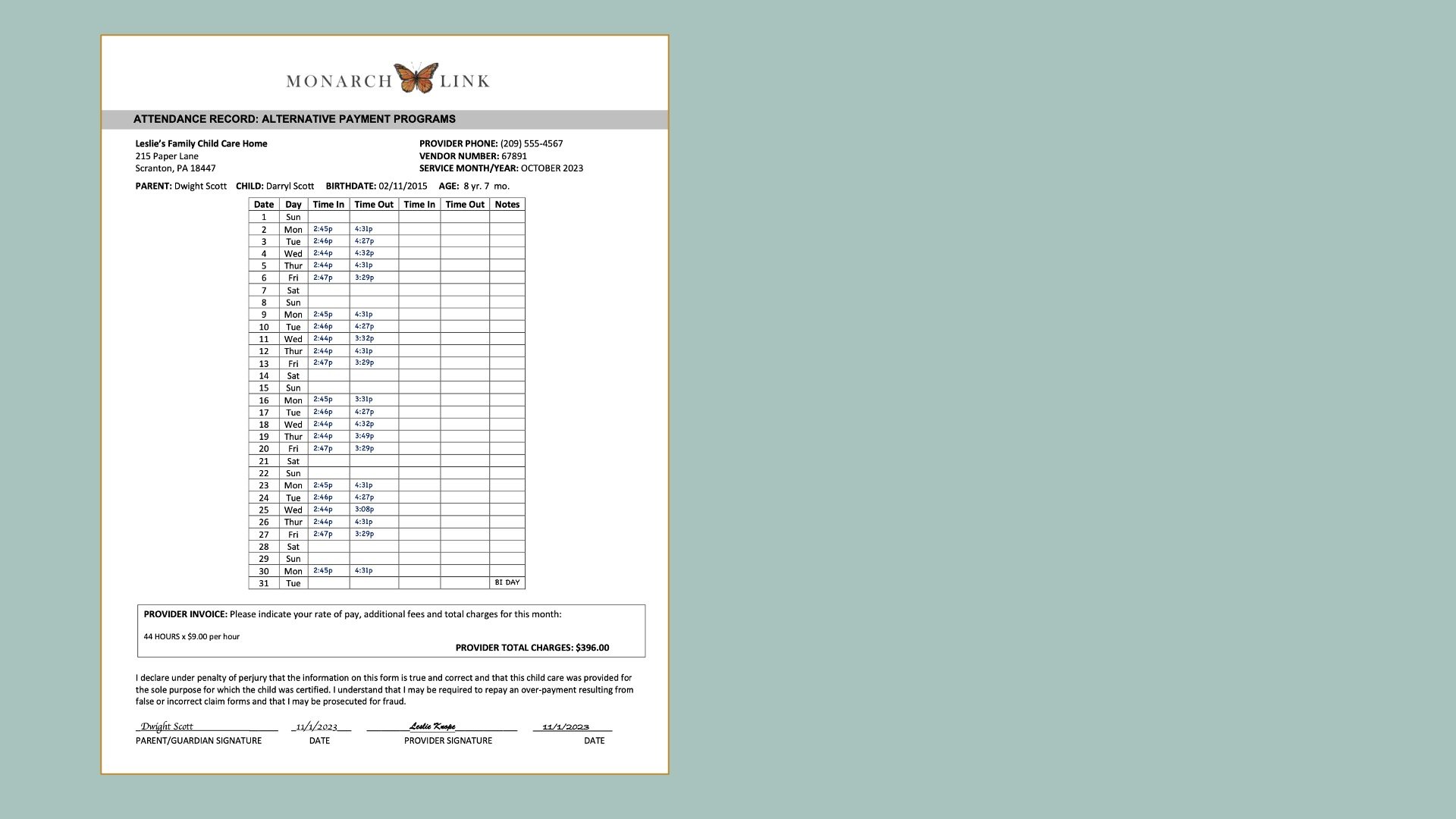

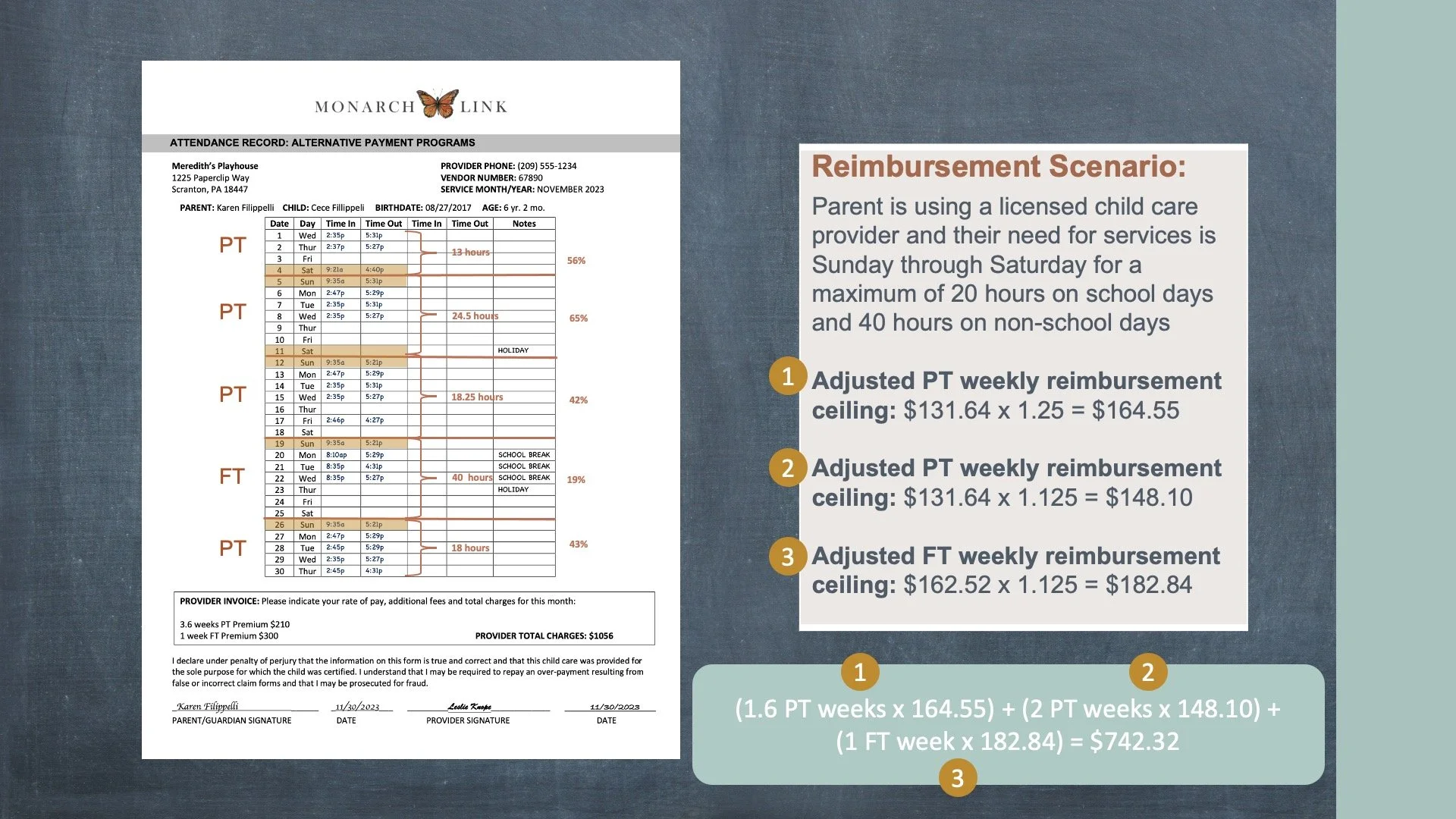

Based on the certified days & hours of services determined at the time of certification or recertification as documented on the Notice of Action, determine if the hourly, daily, weekly or monthly rate applies. Once the most appropriate rate is determined, review the total charges on the provider’s invoice. Reimburse the provider whichever is the least amount between the Provider Invoice or RMR.

NOTE: A Visual Illustration of these Regional Market Rate Categories is available in the resources.

Daily Rate

A daily rate can be used:

Only if child care of 6 hours or more per day is used

No more than 14 days per month

Daily rate cannot exceed the monthly reimbursement ceiling.

Weekly Rate

A weekly rate can be used in two instances:

Part-time weekly rate may be applied for certified care that is less than 25 hours per week

Full-time weekly rate may be applied for care that is 25 hours or more per week

Hourly Rate

An hourly rate may be used:

For less than 25 hours per week & less than 5 hours on any given day.

For full time plus hours of care, which is defined as care that exceeds more than 52.5 hours per week & not covered by the full-time week or monthly rates.

NOTE: Only applicable when one provider is used & additional payment for this purpose cannot exceed the full time weekly or monthly rate

Monthly Rate

A monthly rate can be used in two instances:

Part-time monthly is defined as less than 25 hours per week & need must occur every week in the month.

Full-time monthly is defined as 25 hours or more per week & need occurs every week in the month.

NOTE: In the event that part-time & full-time care is used throughout the month, divide the total hours for the entire month by 4.33. Use the average to determine if the part-time or full-time rate is applicable.

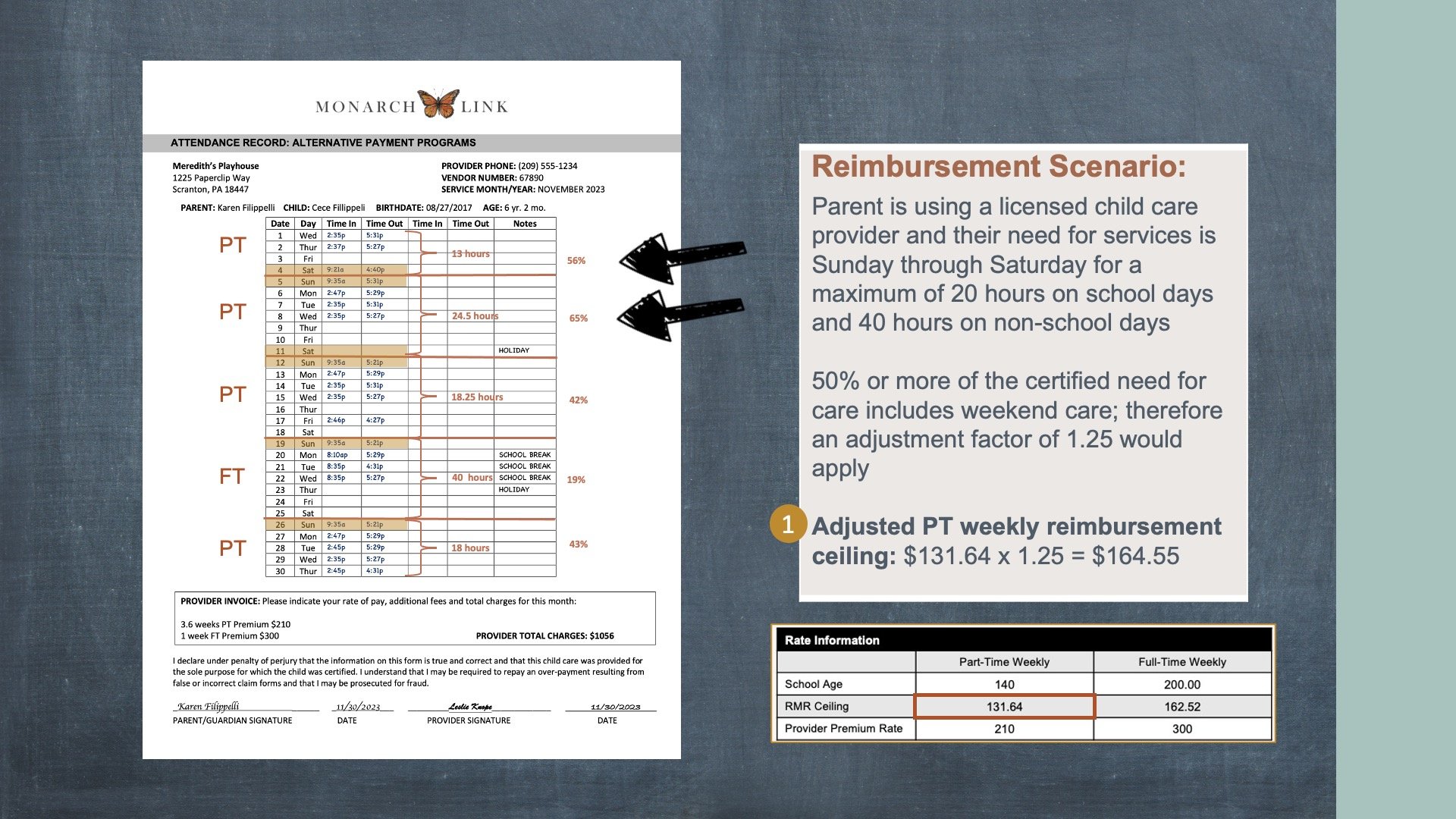

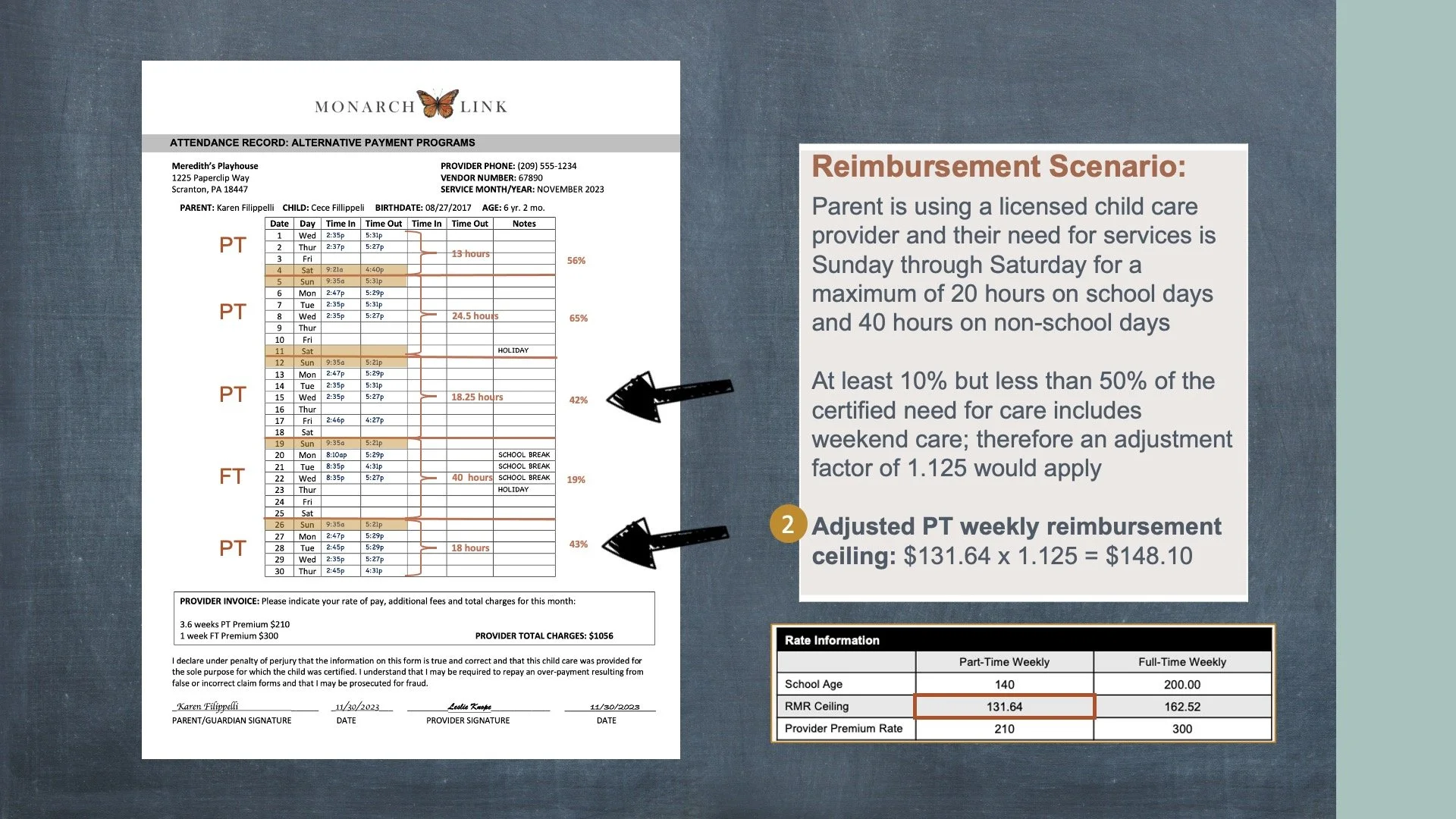

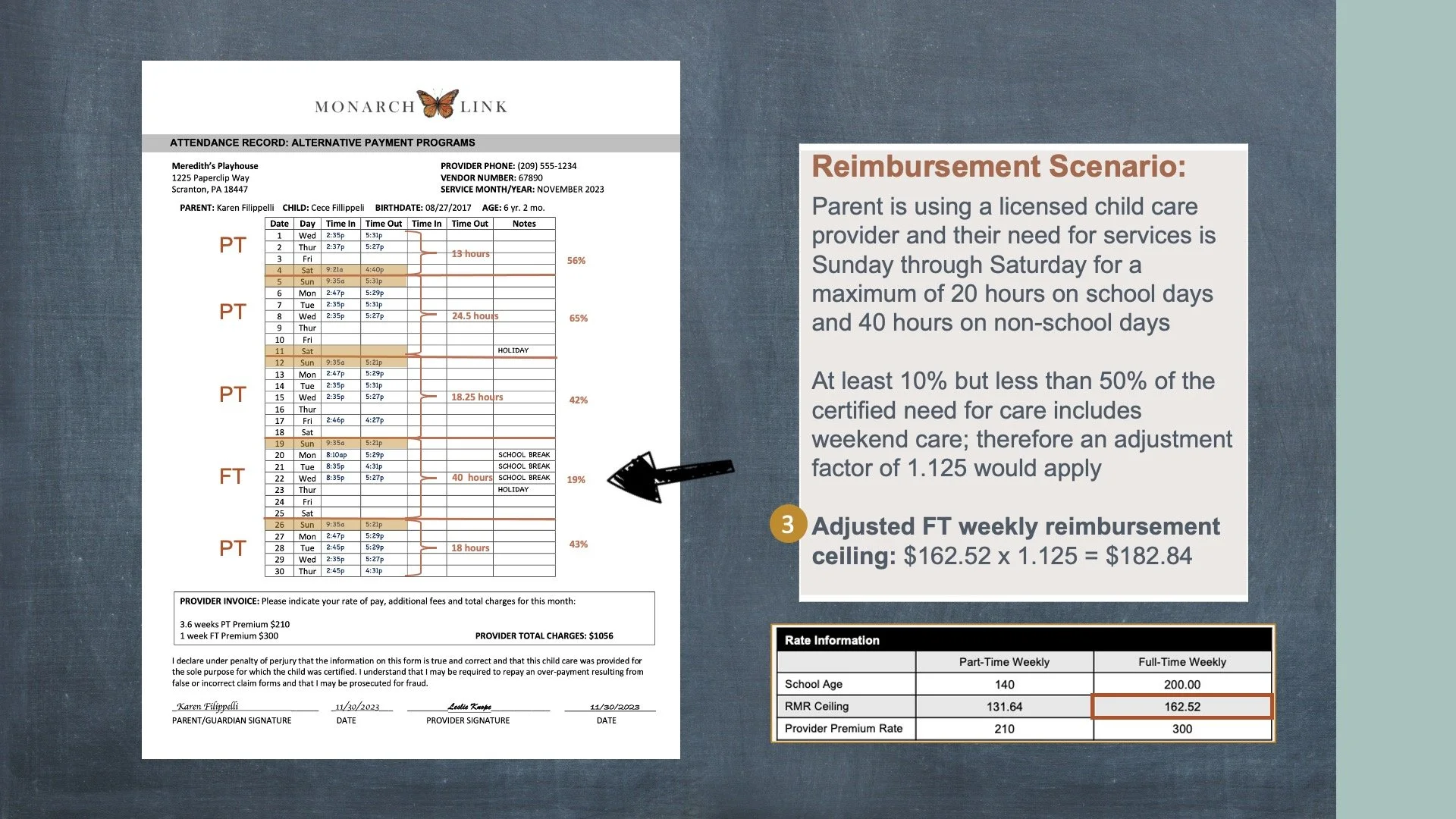

Adjustments for Reimbursements

EVENING & WEEKEND CARE

Adjustments to the maximum reimbursement amount may be applicable for evening & weekend care. This only applies to licensed providers & may not be applied to the hourly rate. In addition, the certified need must include hours of care between 6pm to 6am any day OR Saturday and Sunday all day.

To determine the new rate ceiling, use the following adjustment factors:

When 50% or more of the certified need for care occurs during this period, multiply the reimbursement ceiling rate by 1.25

When at least 10% but less than 50% of the certified need for care occurs during this period multiply the maximum rate by 1.125

CHILD WITH EXCEPTIONAL NEEDS

When services are provided to a child with exceptional needs an adjustment factor may apply. The adjustment only applies when documentation that additional services and/or accommodations for that particular child are being provided, & such services and/or accommodations result in an on-going financial impact on the provided.

For children with exceptional needs, an adjustment factor of 1.2 may be applied & for a severely disabled child, a factor of 1.5 may be applied to the maximum reimbursement ceiling.

NOTE: In the event that a child qualifies under two adjustment factors such as having exceptional needs & using evening and/or weekend care, the contractor shall only apply one adjustment factor which should be the higher adjustment factor of the two.

FAMILY FEES

According to the regulations, the contractor shall offset the amount of the fee paid by the parent in calculating the payment due to the provider If the contractor's policy allows parents to make direct payments of their fees to the provider.

NOTE: The provider shall submit a copy of the parent's receipt to the contractor

UNION DUES

Provider reimbursements may be decreased to cover dues on behalf on the Child Care Provider's United Union.

These deductions include:

Membership dues

Initiation fees

General assessments, &

Payment of any other membership benefit program sponsored by the certified provider organization

What this might look like in a program:

Take the applicable rate ceiling & multiply it by the applicable adjustment factor to determine the adjusted maximum reimbursement ceiling.

Reimbursable Fees

According to the regulations, agencies shall reimburse fees charged by providers such as:

Registration

Materials

Insurance

Reimbursements can be made either in a single payment or pro-rated over a 12-month period, as long as the provider documentation states that this is a required payment from non-subsidized families & the additional fees do not exceed the maximum reimbursement ceiling.

Reimbursement to Alternate/Multiple Providers

An alternate provider may be paid when the regular provider has a non-operational day & parent has to use alternate care or child is ill for a maximum of 10 days per child this fiscal year.

NOTE: Contractors may reimburse an alternate provider in excess of limits if the parent provides a physician verification.

Only 1 provider per child may be used when the provider’s hours of operation can accommodate the parent’s need. The only exception is when the first provider is exempt & the parent chooses a licensed center for group school readiness experiences.

If multiple providers are needed to meet the parents need, payment may never be made for the same portion of a child’s certified need

Issuing Reimbursement

According to the regulations, provider reimbursement must be issued to the provider within 21 calendar days from the date attendance record or invoice was received.

Contractors must set up an electronic reimbursement program for providers so that the reimbursement to providers may be electronically transmitted to the financial institution of their choice.

NOTE: Contractors may not require the providers to use direct deposit or any other form of electronic reimbursement to receive their reimbursements, unless the agency already had a policy in place prior to July 1, 2019.

Provide a description of the reimbursement to the provider, including:

Child(ren) served

Month of service covered by the reimbursement

Contractors do not have the authority to reduce or withhold payments in the absence of a NOA. Any reduction to the parent’s benefit level, including a reduction due to the parent’s violation of program rules, can only be effected through a NOA. The provider must be paid on the original certification of need. Only after the NOA is effective is the provider paid on the new certification of need.

NOTE: In the event that an overpayment or underpayment is identified, contractor’s must ensure a policy is in place to rectify the error.

Cost of Care Plus Rate Payments

Beginning January 1, 2024 through June 2025, contractors must issue providers a monthly, per-child payment intended to supplement subsidized child care reimbursement. The amount per child varies based on the county where the family child care provider is located and the assigned region.

The Department encourages contractors to issue these payments along with their regular subsidy payment to providers and clearly label the Cost of Care Plus Rate payments.

Misleading Records

Contractors should not make payment to a provider if they have information that might include, but is not limited to, the following:

The provider was incarcerated during the claimed to have provided care.

The provider was out-of-state during the time claimed to have provided care.

A licensed provider lost their license & was directed to cease providing care but did not

A provider claimed a relationship to the child that would have precluded TrustLine but, in fact, the relationship did not exist, or the provider had been previously TrustLine denied

A provider used a false identity

If a contractor receives an attendance record that clearly reflects misleading or deceitful information, the contractor must follow their written polices & take appropriate action.

Complete Knowledge Check ❯

After reviewing the video lesson & sketch pad notes, it’s time to check for understanding by completing a Knowledge Check. Note that Individual Knowledge Checks will conclude with a Certificate.